Dodge Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Owning a Dodge in the UAE means driving a car built for power, performance, and style. To protect that investment, having the right Dodge insurance is essential. Whether you drive a muscle-packed Charger or a versatile Durango, a solid insurance plan ensures your peace of mind on the road.

At Lookinsure, we make finding and managing Dodge auto insurance simple and convenient. Along with providing the best insurance comparison tools in the UAE, we also offer helpful guides like this one to make sure you understand every part of your Dodge car insurance policy.

Dodge Car Insurance in the UAE

Dodge insurance in the UAE gives you financial protection against accidents, theft, and damage caused to or by your vehicle. There are two main types of coverage: third-party and comprehensive. Third-party Dodge auto insurance covers the cost of damages to others, while comprehensive plans protect your own car as well.

Given Dodge’s powerful engines and high performance, many owners prefer comprehensive coverage for full protection. It not only covers repairs and replacements but also includes options like roadside assistance and agency repair, making it a smart choice for Dodge drivers in the UAE.

Types of Dodge Car Insurance Plans in UAE

Dodge motor insurance in the UAE is as dynamic as anywhere else. This variety means you have more options, making the final choice more difficult. If you are uncertain which plan suits you best, contact our support for guidance.

Comprehensive Dodge Auto Insurance Explained

Comprehensive Dodge auto insurance covers damages to your vehicle, theft, and third-party liability. This type of insurance is very popular among Dodge owners because it covers many incidents, such as road accidents, fire, vandalism, and even natural disasters. Comprehensive coverage is an ideal option for Dodge owners seeking maximum vehicle protection.

Third-Party Liability Insurance for Dodge Vehicles

First, you need to know that third-party liability insurance is required by law in the UAE, and having it is mandatory. Third-party liability insurance covers damages caused to individuals and properties in an accident where you are at fault. This type of insurance provides basic coverage for your Dodge car. Although it does not cover damages to your vehicle, it ensures that you are financially protected against claims made by third parties.

Specific Coverage for the Dodge Charger

The Dodge Charger is known for its powerful performance and brilliant design. It is crucial to find insurance for the Dodge Charger that fully matches its unique needs. Insurance for the Dodge Charger models, including the GT and Hellcat, should consider factors like the vehicle’s value, usage, and potential repair costs. Like any other vehicle the Dodge Charger insurance cost can vary based on many factors.

Specialized Insurance for the Dodge RAM

The Dodge Ram is a versatile and strong vehicle that demands specialized insurance coverage. Dodge RAM insurance cost varies depending on the truck’s purpose, as some trucks are for personal and commercial use. The driver’s age and driving history also determine the cost. Insurance for the Dodge Ram can be extended with special policies that protect the vehicle against risks associated with possible off-road accidents or transporting heavy loads.

What Are Covered and Not Covered Under Dodge Car Insurance?

When choosing Dodge car insurance, it’s important to know what your policy includes and excludes. Here’s a quick overview:

What’s Covered:

- Accidental damage to your Dodge

- Fire and theft

- Third-party injury and property damage

- Natural disasters (depending on policy)

- Personal accident coverage for driver and passengers

- Optional add-ons like roadside assistance or agency repair

What’s Not Covered:

- Damages from illegal racing or reckless driving

- Driving under the influence of alcohol or drugs

- Using the car for commercial purposes without proper coverage

- Wear and tear or mechanical breakdowns

- Claims filed after policy expiration

Understanding these details ensures your Dodge insurance provides the protection you expect when you need it most.

Dodge Car Insurance Price in UAE

The cost of Dodge insurance in the UAE depends on several factors, including model, driver profile, and coverage type. On average, you can expect:

- AED 1,000–1,400: Older Dodge models with third-party coverage

- AED 2,200–4,500: Newer models with comprehensive coverage

- + Add-ons: For features like roadside assistance or off-road cover

Your Dodge auto insurance price will also vary based on your driving record, claim history, and the car’s market value. Because of these variables, it’s best to compare multiple quotes through Lookinsure to find the most affordable deal.

Factors Affecting Dodge Car Insurance Premiums

Several factors determine how much you’ll pay for Dodge insurance in the UAE:

- Car model and year: Newer and high-performance models usually cost more to insure.

- Driver’s age and experience: Younger drivers often pay higher premiums.

- Claims history: Frequent claims can raise your Dodge auto insurance rates.

- Coverage type: Comprehensive policies cost more than third-party coverage.

- Add-ons: Features like agency repair or roadside assistance increase the premium.

Knowing these helps you understand what impacts your Dodge car insurance cost and how to manage it.

Cheap Dodge Car Insurance – How to Save More

Finding affordable Dodge auto insurance requires extensive research and patience. During this process, it’s important to compare quotes from different providers. Lookinsure allows you to compare rates from multiple insurers and ensure you get the best deal for your Dodge car insurance. Whether looking for the average Dodge Challenger insurance rate or figuring out the Dodge RAM insurance cost, Lookinsure’s platform helps you find affordable coverage options with the best possible quality.

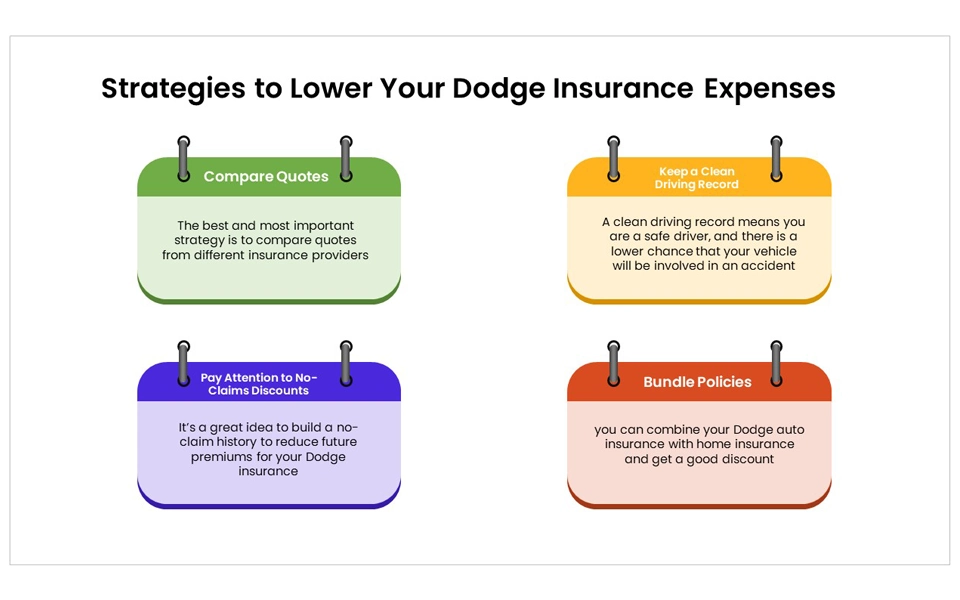

Explore practical strategies to lower your insurance premiums.

| Compare Quotes | The best strategy is to compare quotes from different insurance providers. This helps you tailor a policy that covers only what you need. Lookinsure offers excellent tools for comparing quotes effectively. |

| Keep a Clean Driving Record | A clean driving record shows you are a safe driver, reducing your chances of accidents. Insurance providers offer discounts on premiums to low-risk drivers, encouraging safe driving practices. |

| Pay Attention to No-Claims Discounts | Many providers offer discounts for having a no-claims history. Building a no-claim history can significantly reduce your future Dodge insurance premiums. |

| Bundle Policies | Combine your Dodge auto insurance with another policy, such as home insurance, to receive discounts. Insuring multiple vehicles under the same provider can also lead to savings. |

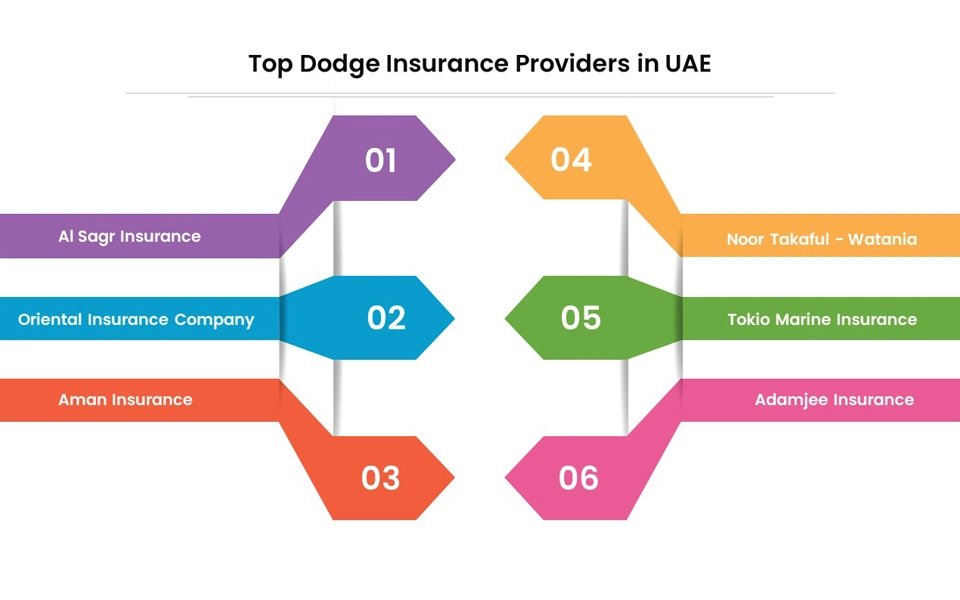

Top Dodge Insurance Providers in UAE

Many great insurance companies in the UAE offer Dodge auto insurance. Some of the top providers include:

How to Buy Dodge Car Insurance Online with Lookinsure

The process for buying Dodge car insurance online is quite convenient, especially when it’s done via Lookinsure’s platform. Lookinsure provides an easy-to-use platform where you can complete these tasks as fast as you can imagine with just a few clicks. Just follow these steps and you'll be done in a few minutes:

- Visit Lookinsure’s website.

- Sign up or log in to your account.

- Enter your Honda car and personal details.

- Compare available Honda Insurance plans.

- Choose the policy that suits you best.

- Make the payment online.

- Receive your policy confirmation instantly.

Required Documents for Your Dodge Insurance

To purchase or renew your Dodge auto insurance, you need the following documents:

| 1 | Copy of your Emirates ID or passport |

| 2 | Vehicle registration |

| 3 | Driver’s license |

| 4 | Proof of address |

| 5 | Previous insurance policy (for renewals) |

| 6 | Proof of no-claims history (if applicable) |

Dodge Car Insurance Renewal Online

Renewing your Dodge car insurance is quick and easy with Lookinsure. Here’s how to do it:

- Visit Lookinsure’s website.

- Sign up or log in to your account.

- Enter your Dodge car and personal details.

- Compare available Dodge insurance plans.

- Choose the one that fits your needs.

- Make the payment online.

- Receive your policy confirmation instantly.

With Lookinsure, renewing your Dodge auto insurance only takes a few minutes—no paperwork, no hassle.

How to Make a Dodge Car Insurance Claim

Filing a claim for your Dodge car insurance is easier than it sounds. Lookinsure helps you submit all the required information and documents quickly, keeping the process simple and stress-free while ensuring you get the compensation you’re entitled to:

- Notify your insurance provider immediately after the incident.

- Log in to your Lookinsure account and open the claims section.

- Fill out the claim form with details of the accident or damage.

- Upload all required documents, including your Emirates ID, driving license, vehicle registration, police report (if applicable), and photos of the damage.

- Submit the claim for review by your insurance company.

- Track your claim online through Lookinsure to stay updated on its status.

- Receive confirmation and, if approved, arrange repairs through authorized garages or get the compensation directly.

Following these steps ensures your Dodge insurance claim is processed smoothly and efficiently, giving you peace of mind after an accident.

Do Not Skip Dodge Car Insurance in UAE

Dodge car insurance is all about protecting your vehicle and ensuring compliance with legal requirements in the UAE. The right insurance provides various types of coverage, such as comprehensive and third-party liability, so you can choose the coverage that best suits your needs. Lookinsure offers quick online quotes and personalized discounts. Its job is to make it easy for you to find the best insurance plan for your Dodge vehicle.