HSBC Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

HSBC car insurance company helps you manage risks and protects you from financial losses in case of accidents, theft, or damage to your vehicle or belongings. As a trusted provider of car insurance in the UAE, HSBC Insurance Company ensures that drivers receive comprehensive yet flexible coverage options, carefully tailored to suit individual needs and lifestyles.

HSBC Car Insurance Overview

HSBC partners with AXA Insurance to deliver premium auto coverage across the UAE. So HSBC car insurance plans combine their banking expertise with AXA's claims handling, offering:

Compliance: Meets UAE compulsory insurance requirements

Cross-Benefits: Discounts for HSBC banking customers

EV Ready: Specialized coverage for electric vehicles

Network Access: 200+ AXA-approved garages nationwide

Types of HSBC Car Insurance in Dubai

HSBC car insurance plans are divided into three main categories:

Comprehensive Car Insurance

This is the most inclusive type of coverage you can imagine when you have HSBC car insurance in the UAE. The comprehensive type will cover car accidents, theft, fire, and natural disasters. It will support the damages done to your vehicle and caused by your car to another individual or property. If you want to drive on the road with peace of mind, HSBC motor insurance in the UAE is one of the best possible options.

Third-Party Insurance

Third party liability insurance UAE is mandatory by the law of the UAE. It covers the damages done by your auto to other individuals or property. These policies are a very economical option, especially for people who rarely use their vehicle, but they leave you with a few options when it comes to HSBC car insurance claim.

Specialized Insurance

HSBC also offers specialized insurance options to fill any gaps in your policy. These additional items (add-ons) provide unique coverage tailored to each individual's specific needs.

Benefits and Coverage of HSBC Car Insurance

As mentioned, HSBC vehicle insurance is a well-recognized choice for car owners. There are many advantages to choosing an HSBC car insurance policy for your car.

HSBC Banking Synergy

15% premium discount for Gold/Platinum cardholders

Premium payments via HSBC credit card installments

Single dashboard for banking + insurance

AXA Claims Efficiency

24/7 multilingual claims hotline (800 692 4685)

Average 72-hour settlement for straightforward claims

Digital HSCB car insurance claim tracking via AXA UAE app

Specialized Repair Network

Priority service at Al Futtaim, Trading Enterprises garages

OEM parts guarantee for major brands

EV-certified repair centers in Dubai/Abu Dhabi

Effortless Claim Process

Making a claim can be long and frustrating. Well, not with HSBC. Your comfort and convenience are a priority for HSBC. Filing a claim with HSBC Insurance Company is straightforward and hassle-free, and the company ensures that claims are processed quickly and efficiently.

What is Covered Under HSBC Car Insurance Plans?

With a comprehensive HSBC car insurance policy you will be compensated for any damages caused to your vehicle by the accidents listed below:

Collision damage (at-fault & not-at-fault)

Theft, fire, vandalism

Sandstorm/flood damage

Third-party property damage (up to AED 5M)

Personal accident cover (driver: AED 100K, passengers: AED 50K)

Add-ons for HSBC Motor Insurance Plans

HSBC motor insurance plans can be reinforced by the use of add-ons. Here are some of the more popular options:

Zero Depreciation: Full claim settlement for cars <3 years

Roadside Plus: 24/7 towing, lockout service, fuel delivery

Rental Cover: Up to AED 500/day replacement car

Off-Road Protection: Desert driving coverage

Key Replacement: AED 3,000 for lost smart keys

Windscreen Cover: Zero-excess glass repairs

What is NOT Covered Under HSBC Car Insurance Plans?

Some damages are never covered regardless of what sort of HSBC car insurance policy you have, so when making a HSBC car insurance claim, make sure the damages caused to your vehicle are not the result of any of the accidents listed below:

Mechanical/electrical breakdowns

Wear & tear depreciation

Racing/off-road accidents (without add-on)

Driving under the influence

Unapproved driver incidents

Documents Required to Buy HSBC Car Insurance in Dubai, UAE

Whether you want to buy HSBC car insurance in Fujairah, Dubai, or any other city in the UAE, and regardless of if you are doin it online or in person, you will need the following documents:

- Personal Identification Documents

- Vehicle Registration Documents

- Driving License

- Policy Number (Your HSBC policy number)

- Incident Proof (such as photos, videos, and a police report)

How to Report Claims for HSBC Car Insurance Claim

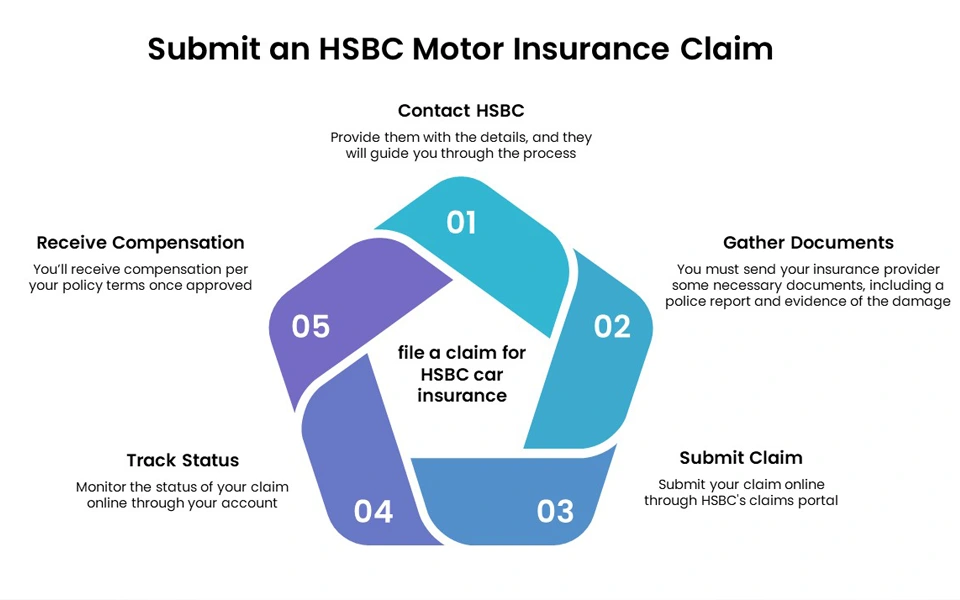

Here's how you can file a HSBC motor insurance claim:

- Contact HSBC: Reach out to the HSBC motor insurance hotline immediately after the incident. Provide them with the details, and they will guide you through the process.

- Gather Documents: You must send your insurance provider some necessary documents, including a police report and evidence of the damage (photos or videos).

- Submit Claim: Submit your claim online through HSBC's claims portal.

- Track Status: Monitor the status of your HSBC car insurance claim online through your account.

- Receive Compensation: You’ll receive compensation per your policy terms once approved.

Documents Required to Claim HSBC Car Insurance in UAE

Having the proper documentation is very important when it comes to making a HSBC car insurance claim. Here are what you need to submit during this process.

- Police report

- Damage photos/video

- Repair estimates

- HSBC policy number

How to Renew Car Insurance Online with HSBC Car Insurance

Just like you can buy HSBC car insurance online, you can renew it in that way as well. Renewing HSBC motor insurance plans is not a demanding process. On the contrary, it’s swift when it’s done on a platform like Lookinsure. These steps need to be followed for your renewal:

- Log In: Log into your Lookinsure account.

- Select Policy: Choose the policy that requires renewal.

- Update Necessary Details: Review and update your details if applicable.

- Confirm and Pay Online: Confirm the renewal and finish the process by making the payment online. After that, you will receive the confirmation and documents related to your policy via email.

Why Buy HSBC Car Insurance Policy in UAE?

Here are a few reasons why buying a HSBC car insurance policy can be a good choice for UAE drivers:

Banking Integration: Premium discounts for HSBC customers

EV Specialization: Battery coverage up to AED 50,000

Regional Expertise: Sandstorm/flood protection

Digital Tools: AXA Claims App with photo assessment

Financial Strength: AA-rated AXA underwriting