Peugeot Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Driving a Peugeot means enjoying a blend of style, comfort, and reliability, but without adequate Peugeot car Insurance, you may be putting yourself at financial risk.

Look at various types of coverage available, tailored options explicitly designed for Peugeot vehicles, and practical steps to obtain competitive Peugeot insurance prices in UAE quickly. Whether you're looking for Peugeot 3008 insurance rates or the cost of insuring other popular models, we’ve got you covered. Let’s make sure your Peugeot remains protected on the busy streets of the UAE.

Peugeot Car Insurance in the UAE

Driving a Peugeot in the UAE, known for its innovative design and efficient performance, requires an insurance plan that understands its specific parts and repair costs. Whether you own a sleek Peugeot 308, a versatile 3008 SUV, or a practical 208, having the right Peugeot car insurance is crucial.

The UAE's demanding driving conditions, from intense summer heat to busy urban roads, make robust Peugeot insurance a smart investment. While third-party coverage meets legal requirements, comprehensive Peugeot car insurance is highly advised to cover the cost of genuine parts and specialized repair services, ensuring your vehicle is restored to its original condition after an incident.

Type of Peugeot Car Insurance Plans in UAE

Whether you're looking for extensive coverage or minimal liability, it’s crucial to know about every option you may have. Below, we delve into the primary types of insurance you can choose from.

Comprehensive Peugeot Car Insurance

Comprehensive Peugeot car insurance offers all-around protection, covering not only third-party liabilities but also damage to your vehicle due to accidents, theft, or natural disasters. This type of policy is ideal for those who want maximum coverage and peace of mind, ensuring that your Peugeot 3008 insurance rates reflect the broader scope of protection against unpredictable events.

Third-Party Peugeot Car Insurance

For those seeking a budget-friendly option, third-party Peugeot car insurance covers only the injuries or damages you may cause to others in an accident. While it’s the minimum legal requirement in the UAE, this type of insurance focuses solely on protecting third-party interests, making it a viable choice for drivers of older models like the 2015 Peugeot 208, who may prioritize lower premiums.

Peugeot Car Insurance Add-ons

Enhancing your Peugeot Insurance policy with add-ons allows you to customize your coverage further. From roadside assistance to rental car reimbursement, add-ons ensure that your specific needs are met. Protect your investment significantly more while enjoying the comfort of your Peugeot 508 car insurance. Our team at Lookinsure can guide you through the available add-ons to find the perfect combination for your driving experience.

Below is a table detailing popular add-ons available for Peugeot car insurance, along with brief explanations of each option:

Add-On | Description |

This service offers help in case of breakdowns, flat tires, or other emergencies while on the road. It includes towing services to the nearest garage or assistance in changing a tire. | |

Rental Car Coverage | It covers the cost of a rental vehicle while your Peugeot is being repaired due to a covered accident or claim, helping you maintain mobility without extra expenses. |

It provides financial protection for you and your passengers in the event of injury or death resulting from an accident, offering compensation for medical expenses and income loss. | |

No Claims Discount Protection | It allows you to retain your no-claims discount even after making a claim, helping keep your premiums lower despite accidents. |

Comprehensive Glass Cover | It covers repairing or replacing damaged windows and windshields without affecting your no-claims bonus. It is ideal for addressing common issues like chips and cracks. |

Theft Protection | This policy offers additional coverage against vehicle theft or attempted theft, ensuring you're compensated for your loss and any damage resulting from a break-in. |

It covers the cost of replacing lost or stolen car keys, including remote and smart key replacements, which can be costly to duplicate for modern vehicles. | |

Modified Vehicle Coverage | Tailored coverage for modified vehicles, ensuring that any necessary alterations or enhancements are adequately covered in the event of a claim. |

Regardless of your model, Lookinsure is committed to helping you find the right Peugeot car insurance that fits your requirements while ensuring your vehicle is well-protected on the road.

What are Covered and Not Covered Under Peugeot Car Insurance?

Before selecting a policy, it's essential to understand the scope of your Peugeot car insurance coverage to avoid unexpected claim rejections.

What is Typically Covered Under Peugeot Insurance?

- Third-Party Liability: Covers costs if you injure someone or damage their property with your Peugeot.

- Accidental Damage: Comprehensive Peugeot car insurance covers repair costs for your own vehicle after a collision.

- Theft, Fire, and Vandalism: Financial protection if your Peugeot is stolen, set on fire, or deliberately damaged.

- Natural Disasters: Coverage for damage caused by events like sandstorms, floods, or hail.

- Personal Accident Cover: Provides compensation for medical expenses for the driver and passengers.

What is Not Covered in a Standard Peugeot Insurance Policy?

- Wear and Tear: Mechanical breakdowns or parts failing due to age are not covered by standard Peugeot insurance.

- Illegal Activity: Any damage occurring while the vehicle is used for unlawful purposes.

- Unlicensed Drivers: Incidents involving a driver without a valid UAE license.

- Undeclared Modifications: Any non-standard parts or accessories not declared to the insurer.

- Off-Road Use: Damage from off-roading is typically excluded unless specified.

Top Peugeot Car Insurance Providers in UAE

Several top-rated insurance providers in the UAE offer policies tailored explicitly for Peugeot Insurance. Partnering with Lookinsure gives you access to competitive rates and comprehensive coverage options designed to protect your investment. Below is a table of Lookinsure affiliates detailing their coverage options and contact information:

Insurance Provider | Coverage Options |

Comprehensive, Third-Party, Personal Accident | |

Oman Insurance Company | Comprehensive, Third-Party, Add-ons |

Comprehensive, Third-Party, Rental Car Coverage | |

Emirates Insurance Company | Comprehensive, Third-Party, Emergency Assistance |

Comprehensive, Third-Party, Multi-Car Discounts | |

Dubai Insurance Company | Comprehensive, Third-Party, Flexible Payment Plans |

Peugeot Car Insurance Price in UAE

Finding a single, fixed price for Peugeot insurance is challenging because premiums are highly personalized. However, to give you a general idea based on market research, you can expect the following annual price ranges:

- Third-Party Peugeot Car Insurance: AED 1,000 – AED 1,800

- Comprehensive Peugeot Insurance: AED 2,500 – AED 5,000+

It's important to remember that these are rough estimates. The final cost of your Peugeot car insurance will be uniquely calculated based on your driver profile, your specific Peugeot model and year, your chosen excess, and other individual factors. The only way to get an accurate price is to compare personalized quotes from multiple providers.

Factors Affecting Peugeot Car Insurance Premiums

Several key elements influence the cost of your Peugeot car insurance. Understanding these can help you see why your premium is priced a certain way.

Main Factors Include:

- Peugeot Model and Year: The market value and repair costs for your specific model (e.g., 208, 301, 5008) are a primary factor.

- Driver's Profile: Your age, driving experience, and claims history directly impact your Peugeot insurance risk assessment.

- Vehicle Use and Location: How often you drive and where you live and park in the UAE affects the premium.

- Coverage Level and Add-ons: A comprehensive Peugeot car insurance policy costs more than third-party, and adding extras like agency repair will increase the price.

- Voluntary Excess: The amount you agree to contribute toward a claim.

Cheap Peugeot Car Insurance – How to Save More

Securing affordable Peugeot car insurance is a common goal. With a few smart strategies, you can find a Peugeot insurance policy that offers great value without compromising on essential protection.

Tips for Finding Cheap Peugeot Insurance:

- Compare Quotes Online: Use comparison websites to view multiple Peugeot car insurance offers side-by-side. This is the most effective way to find competitive rates.

- Opt for a Higher Excess: Agreeing to pay a higher amount in the event of a claim can significantly lower your annual Peugeot insurance premium.

- Protect Your No-Claim Discount: A long history without making a claim is the best way to secure and maintain cheap Peugeot car insurance over time.

- Install Security Features: Equipping your Peugeot with an approved alarm or tracking system can make you eligible for discounts.

- Consider Your Mileage: Accurately reporting a lower annual mileage can lead to a cheaper Peugeot insurance quote.

How to Buy Peugeot Car Insurance Online with Lookinsure?

Buying Peugeot car insurance online is a pretty easy procedure on our website. All you need is a UAE phone number and filling in a few simple forms. Here are the exact steps you'll need to take:

Visit the Lookinsure Website

Open your web browser and go to the Lookinsure website.

Create or Log In to Your Account

- New Users: Click the "Sign Up" or "Create Account" option to fill in the required details.

- Existing Users: Log in using your username and password.

Navigate to the Car Insurance Section

Find the “Car Insurance” tab or homepage section to compare policies.Enter Your Vehicle Details and Personal Information

Fill out the necessary information about your Peugeot, including: - Model and year

- Vehicle identification number (VIN)

- Mileage

- Any modifications or additional features

- Name and address

- Date of birth

- Driver’s license number

- Driving history (accidents, claims, etc.)

Compare Insurance Quotes

Review the various insurance policies available for your Peugeot. Lookinsure will provide you with options that include: - Coverage types (comprehensive, third-party, etc.)

- Add-ons

- Premium costs

- Deductibles

- Discounts

Select Your Preferred Coverage

Choose the policy that best suits your needs and budget. Note any optional coverages or add-ons you may want, such as roadside assistance or personal accident cover.Review Policy Details

Thoroughly read the terms and conditions associated with your selected policy. Ensure you understand all coverage benefits and exclusions.Complete Payment

Once you are satisfied with your policy choice, proceed to the payment section. Enter your payment information securely to finalize the purchase or renewal. You can pay using credit and debit cards, Apply Pay, Google Pay, and BNPL services such as Tabby and Tamara.Receive Confirmation

After your payment is processed, you will receive an email confirmation with your policy details and coverage effective date. Please save this document for your records.Download or Print Your Policy

You may be able to download a digital copy of your insurance policy or print it out for your records.

Peugeot Car Insurance Renewal Online

Renewing your Peugeot car insurance online is a quick and hassle-free process that ensures you never risk driving without valid coverage.

Steps to Renew Your Peugeot Insurance Online:

- Log In: Access your account on your insurer’s website or a comparison portal.

- Select Policy: Choose your existing Peugeot car insurance policy for renewal.

- Review and Update: Check all details are correct and adjust your coverage or excess if needed.

- Get a New Quote: The system will generate your renewal quote for your Peugeot insurance. You can often see if you’ve qualified for any new discounts.

- Make Payment: Securely pay for your renewed Peugeot car insurance policy online.

- Receive Certificate: Your updated insurance certificate will be emailed to you instantly.

Documents Required for Peugeot Car Insurance

To streamline your experience, having the necessary documents ready when purchasing or renewing your policy is essential. Below is a list of the documents required for Peugeot car insurance:

Document | Description |

Vehicle Registration Document | Provide proof of vehicle ownership detailing the registration and specifications of your Peugeot. |

Emirates ID | A valid Emirates ID to verify the identity of the policyholder. |

Driving License | A copy of a valid driver's license is required for the vehicle's primary driver. |

No Claims Discount Certificate | If applicable, this certificate shows your no-claims history, which can help reduce your premium. |

Proof of Address | Recent utility bills or bank statements that serve to confirm your current residential address. |

Previous Insurance Policy | A copy of your current or previous insurance policy can provide context for your coverage needs. |

Inspection Report (if applicable) | Required for older vehicles or those with modifications to assess their condition and value. |

How to Make a Peugeot Car Insurance Claim?

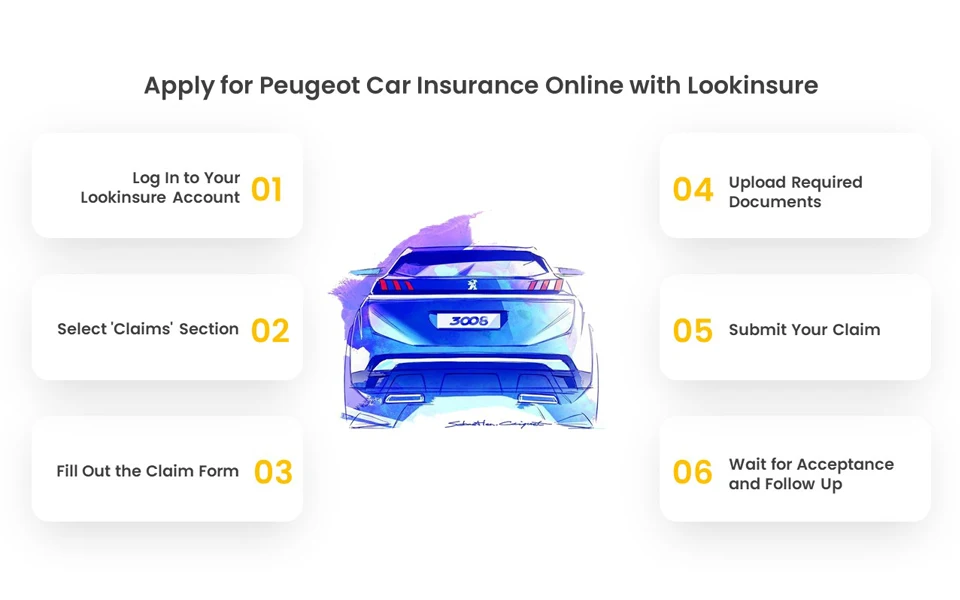

Filing a claim for your Peugeot car insurance through Lookinsure is much different than filing a claim yourself. Our experts follow most of the process on your behalf with your insurer. You must fill out forms and upload documents to your Lookinsure account. Follow these steps:

- Log In to Your Lookinsure Account

- Select 'Claims' Section

- Fill Out the Claim Form

- Upload Required Documents: Attach any supporting documents, such as your vehicle registration, driving license, photos of the incident, and any other relevant evidence.

- Submit Your Claim

- Wait for Acceptance and Follow Up

Secure Peugeot Car Insurance Today!

Securing Peugeot car insurance involves understanding the various types of coverage available, including comprehensive and third-party options, and choosing beneficial add-ons. Still, if you need to know more about Peugeot motor insurance, you can get a quote by clicking the blue button on our homepage.