Zurich Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Zurich Insurance Group is a prominent name in the car insurance landscape, known for its solid presence and exceptional service within the UAE insurance market.

Zurich Car Insurance Overview

Zurich Insurance Company is a global leader in the UAE auto insurance market with over 150 years of industry expertise. Offering tailored Zurich Motor Insurance solutions for individuals and businesses, Zurich combines innovation with reliable protection. From basic third-party coverage to comprehensive plans for luxury vehicles and fleets, Zurich prioritizes customer safety with efficient claims processing and 24/7 support.

Choosing Zurich vehicle insurance ensures financial security on UAE roads, backed by the company's AA-rated financial stability and customer-first approach.

Types of Car Insurance Plans Offered by Zurich Insurance Company

Zurich car insurance plans in Dubai are tailored to meet different needs and preferences. Below is a breakdown of the different coverages and insurance plans available:

Insurance Plan | Coverage Details |

Comprehensive Coverage | Covers damages to your vehicle due to accidents, theft, fire, vandalism, and natural disasters. |

Includes third-party liability coverage for damages caused to other vehicles or property. | |

Offers personal accident cover for the driver and passengers. | |

Third-Party Liability | Basic coverage for damages caused to other vehicles or property in an accident. |

Does not cover damages to your vehicle or personal injuries. | |

Collision Coverage | Protects against damage to your vehicle resulting from collisions, regardless of fault. |

Provides financial compensation in case of injury or death resulting from an accident. | |

Fire and Theft Coverage | Protects against the loss of your vehicle due to fire or theft. |

Specialized Vehicle Insurance | Tailored plans for specific types of vehicles, such as motorcycles, vans, and commercial insurance vehicles. |

No Claims Discount | Offers a discount on annual premiums for claim-free years, rewarding safe driving. |

Benefits of Zurich Car Insurance

Choosing Zurich car insurance online Dubai has many advantages designed to enhance your driving experience and provide paramount security on the road. Here are some key benefits:

- Extensive Coverage Options: From basic liability to comprehensive solutions, you can tailor your Zurich auto insurance plan to meet your specific needs, safeguarding against damages, theft, and personal injuries.

- Exceptional Customer Service: Zurich is renowned for its responsive support team, which can assist you through the Zurich auto insurance claims process or answer any inquiries.

- Convenient Online Management: Enjoy a seamless online experience to manage your Zurich vehicle insurance policies, making it easy to access your information and make changes as needed.

- Positive Customer Feedback: You can benefit from favorable Zurich auto insurance reviews, which highlight customer satisfaction and the company’s commitment to delivering reliable insurance products.

- Tailored Motorcycle Coverage: Zurich also offers Zurich motorcycle insurance, ensuring that whether you drive a car, truck, or motorcycle, you have tailored coverage solutions.

What is Covered Under Zurich Motor Insurance Plans?

Collision damage and overturning

Theft, arson, and vandalism

Third-party bodily injury/property damage

Emergency medical costs for occupants

Natural disasters (sandstorms, floods)

Add-ons for Zurich Car Insurance Plans

24/7 Premium Roadside Assistance:

Towing to the nearest garage

Battery jump-starts

Flat tire replacement

Emergency fuel delivery

Lockout service (up to AED 500)

Rental Car Cover:

Up to AED 400/day replacement vehicle

14-day coverage period

Includes comprehensive insurance on the rental

Desert driving coverage

Sand recovery services

Under-chassis damage protection

Specialized 4x4 assistance

No-Claim Discount Shield:

Protect the discount after the first claim

Applies to comprehensive policies

Maximum 50% NCD protection

AED 10,000 for stolen belongings

Includes electronic devices

Covers items in a locked vehicle

Windscreen Protection Plus:

Zero-deductible glass replacement

Emergency chip repairs

Includes sunroof damage

Enhanced Personal Accident Cover:

Increased death/disability benefits

Additional passenger coverage

Worldwide protection extension

What is Not Covered Under Zurich Car Insurance Plans?

Mechanical/electrical failures

Wear and tear deterioration

Racing or illegal driving activities

Damage under the influence of alcohol/drugs

Unauthorized driver incidents

Documents Required to Buy Zurich Car Insurance in Dubai, UAE

When applying for Zurich Insurance or filing a claim, you typically need the following documents:

- Identification: A valid Emirates ID or passport.

- Proof of Address: Recent utility bills or rental agreements.

- Insurance Policy Details: Your existing policy number and documents.

- Claim Documentation: Specific documents related to the claim, such as photographs, receipts, and incident reports (if applicable).

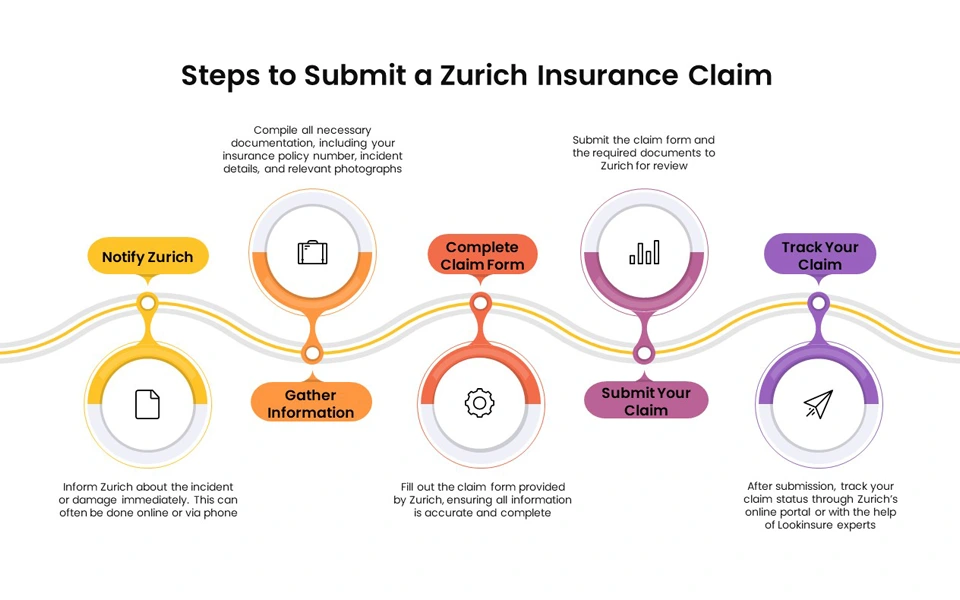

How to File Zurich Car Insurance Claim

Filing a claim with Zurich Insurance can be straightforward, especially when you use Lookinsure. To make the process easier, contact our experts through the Lookinsure platform. Here's an overview of the steps involved in filing a claim, along with how we support you:

Steps to File a Claim

- Notify Zurich: Inform Zurich about the incident or damage immediately. This can often be done online or via phone.

- Gather Information: Compile all necessary documentation listed below.

- Complete Claim Form: Fill out the claim form provided by Zurich, ensuring all information is accurate and complete.

- Submit Your Claim: Submit the claim form and the required documents to Zurich for review.

- Track Your Claim: After submission, track your claim status through Zurich’s online portal or with the help of Lookinsure experts.

How Lookinsure Helps

- Guidance: Our experts will walk you through each claim process step.

- Documentation Help: We assist you in gathering and preparing the necessary documentation.

- Questions Answered: Our team will address any questions or concerns you have promptly.

- Smooth Experience: With our support, you can ensure a smoother claims experience and get assistance for a timely resolution.

Documents Required for Zurich Car Insurance Claim

Completed Zurich claim form

Original police report

Repair estimates from approved garage

Driver's license and registration copies

Bank details for settlement

How to Renew Zurich Car Insurance Plan?

Log into Lookinsure account

Access "My Policies" and select Zurich plan

Confirm vehicle details and coverage needs

Pay securely via credit/debit card or installments (Tabby/Tamara)

Receive digital policy immediately

Why Buy Zurich Car Insurance Policy in UAE?

Global Strength: AA-rated financial security

Priority Service: VIP claims handling for premium customers

Payment Flexibility: 0% interest installments available

Industry Recognition: 2023 MENA Insurance Provider of the Year

Exclusive Benefits: Free accident towing and roadside assistance