Protect Your BMW with the Right Insurance Plan

Flexible installments to pay later with

And

Regulated by the Government of Dubai

When it comes to BMWS, opinions are divided. Some BMW lovers prefer a 10-year-old model to any brand-new car. There is merit to their loyalty to this German car brand. BMWs might cost a fortune to maintain, but all it takes is sitting behind a well-maintained V6 and falling in love with them.

The right BMW car insurance can assist with maintaining the vehicle and sourcing quality services and genuine spare parts.

What is the Best Auto Insurance for BMW?

Good insurance can provide peace of mind by ensuring your vehicle will get the best care possible in the event of an accident. Car insurance for BMW owners can be even more important than that as they drive around in a pretty expensive car known for its high maintenance costs.

Top BMW Auto Insurance Providers in UAE

Insurance Company | Description |

Adamjee Insurance | For BMW auto insurance, Adamjee Insurance stands out as a reliable option for BMW owners in the UAE. Renowned for its comprehensive coverage and competitive rates, the company recognizes the unique needs of BMW vehicle owners. Their insurance policies for BMW cars are designed to provide maximum protection for these precision-engineered vehicles. |

Dubai National Insurance Company (DNIC) | DNIC offers specialized car insurance for BMW models that caters to the specific requirements of these premium vehicles. Whether you own a BMW 3 series or an M4, their tailored insurance solutions cover you from all angles. Their deep understanding of BMW vehicles makes them a top choice for BMW auto insurance. |

Al Buhaira National Insurance Company (ABNIC) | ABNIC provides some of the most comprehensive coverage options for BMW M3 car insurance. They recognize that BMW owners require more than standard protection—they need a policy that matches the sophistication of their vehicle. |

Salama Takaful Insurance | Salama Takaful insurance offers innovative BMW car insurance solutions that blend traditional coverage with modern flexibility. Their policies for BMW mini car insurance are particularly noteworthy, providing comprehensive protection for smaller BMW models. |

Abu Dhabi National Takaful Company (ADNT) | ADNT is one of the top providers of specialized car insurance for BMW vehicles. Their policies are designed to provide peace of mind for BMW owners and cover everything from minor scratches to major repairs. |

Here is a description of the available options out there for BMW car insurance:

Comprehensive Coverage Options for BMW Vehicles

When selecting BMW car insurance, comprehensive auto insurance coverage is crucial. The best insurance policies for BMWs go beyond basic protection, offering:

- Full protection against accidental damage

- Coverage for specialized BMW parts

- Protection against theft and natural disasters

- Worldwide coverage for international travel

Third-Party Liability BMW Auto Insurance

While comprehensive coverage is ideal, third-party liability insurance is also favorable. This type of car insurance for BMW provides essential protection against legal and financial risks associated with accidents involving third parties. But you must remember that this policy will not cover any damages to your vehicle.

BMW Car Insurance Add-ons

While BMWs are sometimes known as problematic cars, there are ways you can solve a lot of them by buying the right BMW car insurance. To truly protect your investment, you can consider these additional coverage options:

Coverage Option | Description |

Zero Depreciation Cover | This ensures you will receive the full cost of replacing car parts made of plastic, rubber, and fiberglass without accounting for wear and tear. |

Engine Protection | In standard car insurance policies, engine damage caused by factors such as water ingress, oil leakage, or mechanical failures is usually not covered unless it is directly related to an accident. However, this add-on offers financial coverage for damage to your car’s engine, including its internal components. |

Roadside Assistance | An old BMW can be fun to drive but is also known for occasionally breaking down. Roadside assistance provides free towing, making such situations far more tolerable. |

Rental Car Provisions During Repairs | BMWs are known for their complicated mechanical setup, making them more time-consuming than conventional cars. This option ensures you get a free rental car while your vehicle is in the garage. |

Whether you drive a sporty coupe or a luxury sedan, Lookinsure makes it easy to find the perfect insurance plan. Get the coverage you need with options that match your car’s value, usage, and features. Also, don't let any costs hold you back from fully protecting your luxury car. With Lookinsure, you can get car insurance with Tamara and pay in no-interest installments.

BMW Car Insurance Renewal Online

Gone are the days of complicated insurance renewals. Now, BMW auto insurance can be renewed with just a few clicks or taps:

- Visit Lookinsure’s website

- Log in to your account

- Select your current policy

- Review and confirm details

- Make payment online

How to Claim a BMW Car Insurance Policy?

The primary purpose of insurance coverage is filing a claim. While the process might seem daunting due to insurance companies' stringent fraud prevention measures, understanding the steps can make it much smoother.

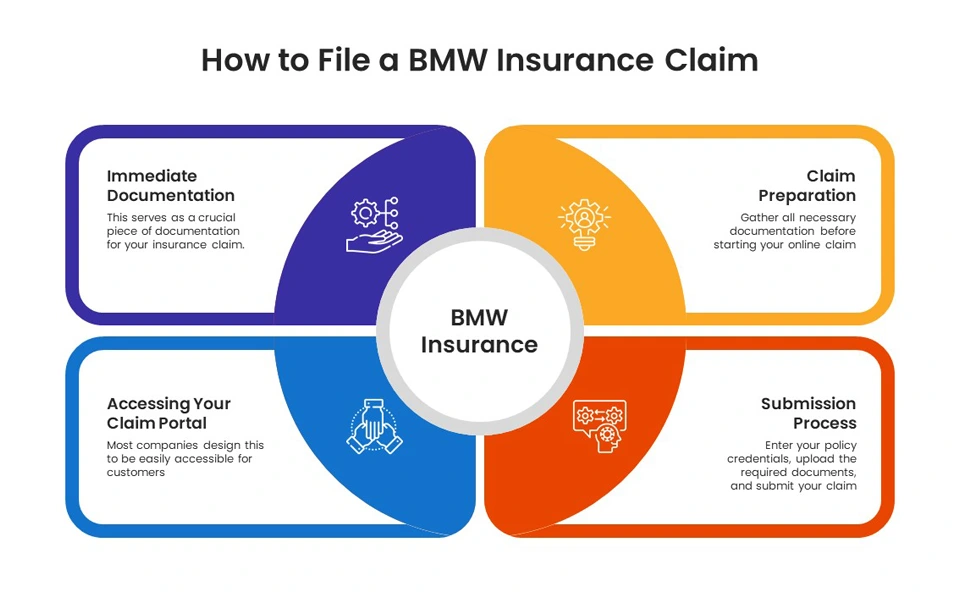

How to File a BMW Insurance Claim

The claims process can typically be completed online or in person through your insurance provider. While specific steps may vary slightly between companies, here's a general approach to filing a claim:

Immediate Documentation

First, the accident should be reported to local authorities, and an official police report should be obtained. This serves as a crucial piece of documentation for your insurance claim.

Accessing Your Claim Portal

Log into your insurance provider's website and locate the claims section. Most companies design this to be easily accessible for customers.

Claim Preparation

Gather all necessary documentation before starting your online claim, including:

- Official police report

- Copy of your driver's license

- Vehicle registration certificate

- Comprehensive photos of vehicle damage

- Detailed written account of the accident

Submission Process

Enter your policy credentials, upload the required documents, and submit your claim. Then, patiently await the insurance company's response.

Pro Tip: Thoroughness and accuracy in documentation can significantly expedite your claims process, reducing potential complications or delays.

Documents Required for BMW Car Insurance

When applying for BMW auto insurance in the UAE, you must submit the following document, whether you are buying your policy online or in person:

- Vehicle Registration

A copy of your car registration card (commonly referred to as the Mulkiya in the UAE) is mandatory. This document serves as proof of vehicle ownership and is required by all insurance providers.

- Driver’s License

Another requirement is a valid UAE driver’s license. Some insurers may require an international driver’s license or a locally converted one for foreign residents.

- Emirates ID

Your Emirates ID is necessary for identification. Some insurance companies also accept UAE PASS as an alternative for quicker online applications.

- No Claims Certificate (if applicable)

If you have a clean claims history, providing a No Claims Certificate from your previous insurer can qualify you for discounts, helping to lower your insurance premium.

Additional Documents (Specific Cases)

For financed cars: A letter from your financing bank confirming the car details.

For fleet vehicles: Company registration documents and authorization letters may be required.

Preparing these documents ensures a seamless application or renewal process for Tesla car insurance in the UAE.

Choosing the right BMW car insurance is about more than just price. It's about thorough protection, specialized service, and peace of mind. By understanding your options and selecting a provider who truly understands the finer points of BMW auto insurance, you can confidently enjoy your driving experience.