Car Insurance with Tamara: 4 Installments, 0% Interest

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Sorting out your car insurance in the UAE doesn’t have to drain your budget all at once. Many drivers now prefer using car insurance Tamara options because they make the whole process lighter and easier to manage.

With Tamara car insurance, you can arrange your policy right away and split the cost into simple monthly payments instead of paying everything upfront. It gives you the breathing room to stay fully covered while keeping your budget intact.

What is Tamara?

Tamara, a leading Buy Now, Pay Later (BNPL) service provider in the UAE, stands out for its user-friendly approach, transparency, and dedication to customer satisfaction. By partnering with businesses like Lookinsure, Tamara now includes essential services, making insurance options in Tamara Dubai more accessible.

The Tamara payment system allows customers to enjoy financial flexibility without worrying about interest or hidden charges.

If you're looking for another easy way to manage your insurance payments, you can now pay for your coverage using insurance with Tabby. With flexible, interest-free installments, Tabby offers a smooth, convenient payment solution for your insurance needs. Explore more about how this option can benefit you today!

How to Use Tamara for Car Insurance Payments on Lookinsure

When it comes to managing your insurance premiums, insurance installments make it easier to spread out your payments over time. With flexible payment options, you can secure the coverage you need without any financial strain. Find out how our installment plans can help you enjoy affordable protection today!

Using Tamara for car insurance payments on Lookinsure is a straightforward process that you won’t need to worry about until you have reached the final step: making payment. Here's a step-by-step guide to help you get started:

Create an Account

The first step is to create a Tamara account. Visit Tamara's official website or download the app, and sign up by providing your basic details, such as your name, email address, and phone number. You may also need to verify your identity to activate your account, which is done either using UAE PASS or your Emirate ID.

Select Your Insurance Plan

Once your Tamara account is set up, visit the Lookinsure platform. Click on “Instant Quotes,” answer a few questions, browse the available car insurance options, and choose a plan that meets your needs. Whether you're looking for comprehensive coverage, third-party liability insurance, or additional add-ons, Lookinsure offers a variety of options.

Choose Tamara at Checkout

When you're ready to pay, proceed to the checkout page and select Tamara as your preferred payment method. This step links your Lookinsure transaction with your Tamara account, ensuring a smooth and secure process.

Split Payments

After confirming your transaction, the total cost of your car insurance will be divided into four equal installments. Tamara will provide you with a clear payment schedule so you'll know precisely when each installment is due. By using car insurance Tamara services, you can enjoy peace of mind knowing your payments are manageable and interest-free.

After confirming, your payment will be divided into four equal parts.

For example if your policy costs AED 1000, your monthly payment will be calcuatd as demonstrated below:

Comprehensive policy AED 1000 / 4 = AED 250 per month

Monitor Your Payments

Once your payment plan is active, you can track your installments through the Tamara app or website. The platform sends reminders before each due date, helping you stay on top of your payments and avoid late fees.

Car insurance with Tamara through Lookinsure combines affordability, convenience, and flexibility. You can spread the cost of your policy over four interest-free installments, making it easier to manage your budget without compromising on essential coverage.

When you finish your transaction on Lookinsure's website, Tamara, select car insurance as your preferred payment method.

Buy Car Insurance with Tamara for Any Type of Policy

A wide variety of insurance policies are compatible with Tamara car insurance. Most comprehensive and third-party liability plans available on insurance aggregator platforms can be paid for using a car insurance with Tamara payment method.

Whether you are insuring a new, used, or luxury vehicle, you can likely use car insurance Tamara to finance your premium. This wide eligibility makes Tamara insurance a versatile payment solution for nearly every type of driver and vehicle in the UAE.

What Companies Offer Car Insurance with Tamara?

Every insurer on Lookinsure supports Tamara as a payment method. This include some of the most reputable car insurance companies in the UAE, such as Methaq, Sukoon Insurance, Oman, Emirates Takaful insurance and many more.

So no matter which company you choose, you can pay car insurance in instalments and enjoy an insure now pay later experience. It gives you more freedom to choose the policy you want without worrying about one large upfront payment.

Why Choose Tamara for Car Insurance?

Regarding managing your insurance costs effectively, car insurance with Tamara offers several advantages that make it an attractive option for UAE residents seeking insurance with Tamara. Let's explore how this service can help reduce your financial burden:

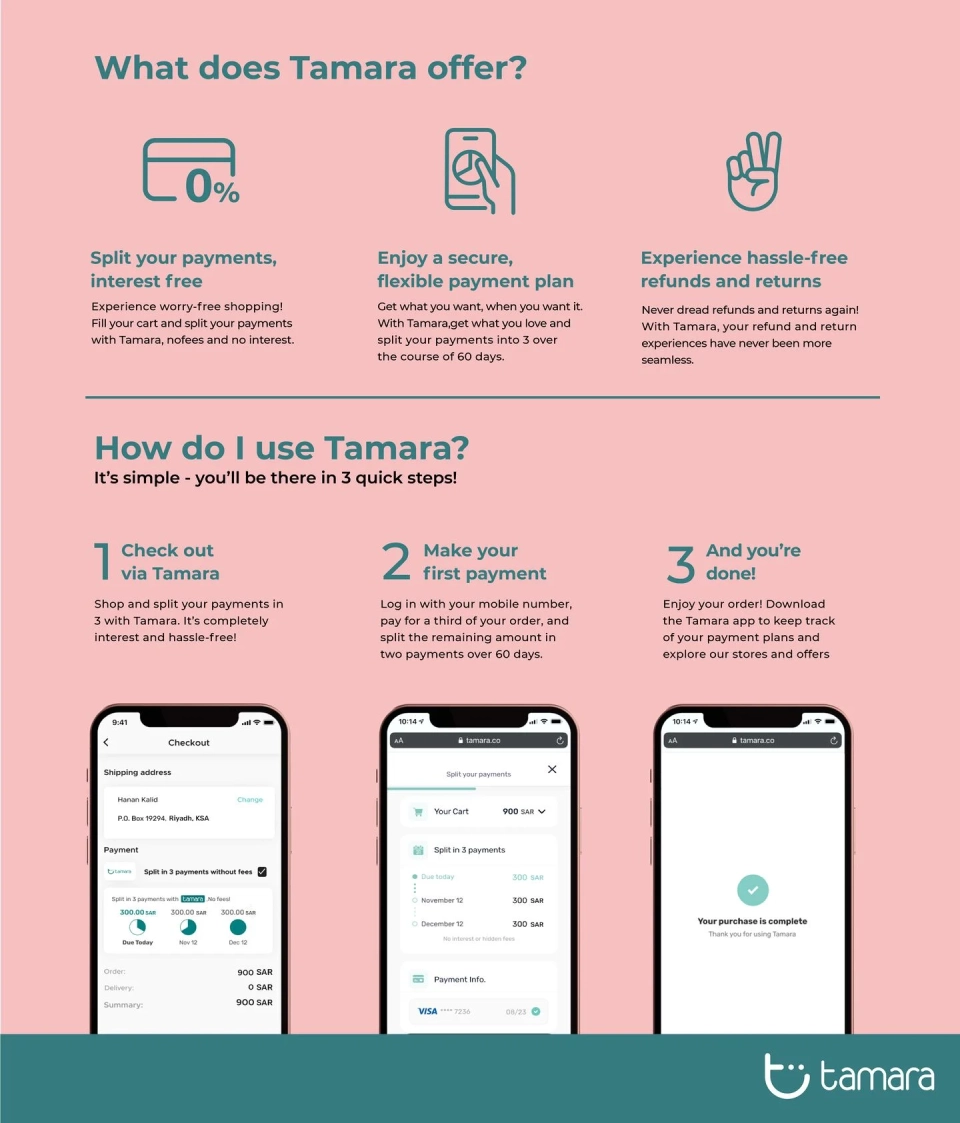

Buy Now, Pay Later

Buy-now-pay-later (BNPL) services represent a modern solution for managing expenses. They allow consumers to make purchases upfront and pay for them later in smaller installments. This approach is particularly beneficial for significant costs, such as car insurance, Tamara plans, and other essential services.

Exclusive Deals and Offers

One significant benefit of using Tamara's car insurance services is access to exclusive deals and discounts: Lookinsure, a leading aggregator, partners with top insurance providers to offer competitive rates. When you choose Tamara, you gain payment flexibility and enjoy cost savings through special offers.

Pay in 4 Interest-Free Installments

Managing insurance Tamara payment UAE costs becomes much easier with the four-installment plan. Tamara solves this problem by allowing you to pay in four equal, interest-free installments. This feature makes car insurance with Tamara an excellent option for budget-conscious individuals who want to spread their expenses over time.

Online Payment

Convenience is key in today's digital age. Tamara offers a secure and streamlined online payment experience, allowing you to complete transactions anywhere.

Tamara Car Insurance Payment Options

For drivers seeking flexibility, Tamara car insurance payment plans offer an excellent solution. You can easily get your car insurance Tamara through a "Pay in 4" or "Pay Next Month" option, splitting the total premium into manageable, interest-free installments. Choosing car insurance Tamara payment at checkout allows you to secure your policy immediately while spreading the cost over time. This makes Tamara insurance a popular choice for managing your budget without delaying essential coverage.

When is Tamara Car Insurance Activated?

Your insurance becomes active as soon as you complete your purchase on Lookinsure. Even though you will pay car insurance in 4 payments, your policy starts right away and your vehicle is fully covered from day one.

Eligibility Criteria for Tamara Car Insurance Payments

To use a Tamara car insurance plan, you must meet simple eligibility criteria. Generally, you need to be a resident of the UAE, at least 18 years old, and have a valid debit or credit card. The process to qualify for car insurance Tamara involves a quick financial check at the point of purchase. This streamlined process for car insurance Tamara payment ensures that many drivers can access the benefits of Tamara insurance with minimal hassle.

Compare – Car Insurance by Tamara vs. Full Payment

Choosing Tamara car insurance over a full upfront payment provides immediate financial relief. The car insurance Tamara payment option improves your cash flow by dividing the cost into smaller parts. While paying in full settles the bill immediately, opting for car insurance Tamara allows you to keep your savings intact for other expenses. For those who prefer to pay later, Tamara insurance offers a disciplined, interest-free structure that makes comprehensive coverage more accessible.