Affordable Chevrolet Insurance – Compare & Save Today!

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Chevrolet cars, also known as Chevys, are widespread in the UAE. They are loved for their excellent performance and design. Owning a Chevrolet car in the UAE is like having a significant investment, and just like every other investment, your Chevy needs to be protected. That’s why Chevrolet insurance in the UAE is so important.

A good Chevy insurance policy would protect your investment, so picking the right Chevrolet car insurance online is crucial. Regardless of your Chevrolet model, you will get financial protection to ensure you are fully supported in case of theft, road accidents, or natural disasters.

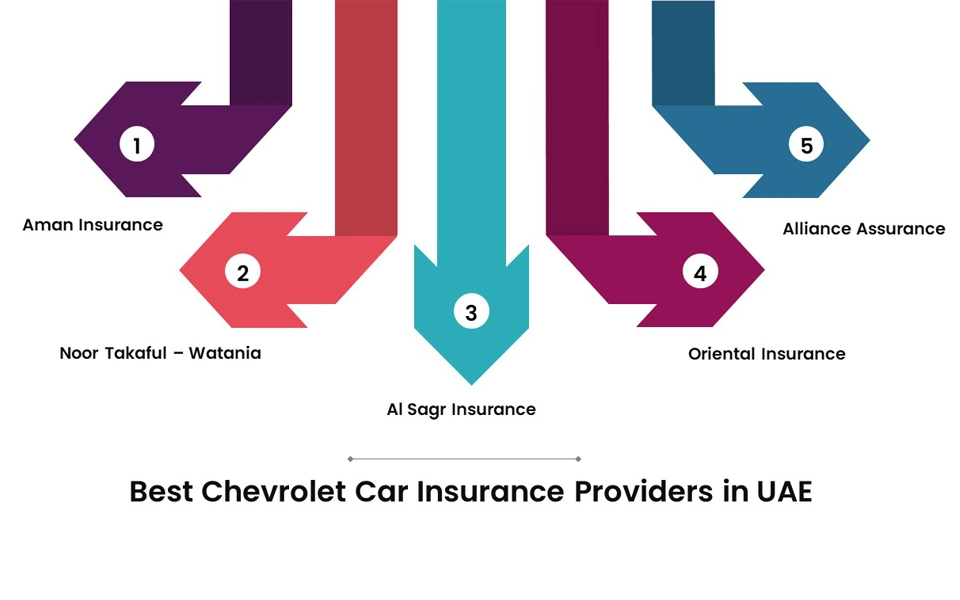

Top Chevrolet Insurance Companies in UAE

Here, you can review some of the leading insurance companies in the UAE that offer Chevrolet car insurance.

Aman Insurance

Aman Insurance, headquartered in Dubai, is a leading provider of innovative insurance solutions in the UAE. It is committed to delivering comprehensive plans and a seamless customer experience and ensures a convenient claim process, making it a trusted choice for individuals and businesses alike.

- Key Features: Comprehensive plans, convenient claim process

Noor Takaful – Watania

Noor Takaful insurance—Watania is a Sharia-compliant insurance provider offering ethical and transparent Takaful solutions. Known for its high coverage limits and competitive pricing, the company prioritizes customer satisfaction and financial security and aligns with Islamic principles.

- Key Features: High coverage limits, competitive pricing

- Contact Information: watania.ae/

Al Sagr Insurance

Established in 1979, Al Sagr Insurance is one of the UAE’s oldest and most reputable insurance companies. Renowned for its reliable service and extensive network of garages, Al Sagr provides tailored insurance solutions to meet its clients' diverse needs.

- Key Features: Reliable service, vast network of garages

- Contact Information: alsagr.com/Ecommerce/#/home

Oriental Insurance

Here's the gist of most useful information on Oriental insurance:

- Key Features: Personalized options and discounts, comprehensive coverage

- Contact Information: orientalinsurance.org.in

Alliance Assurance

Oriental Insurance, a trusted name in the insurance industry, offers a wide range of personalized options and discounts to suit individual and corporate needs. Focusing on comprehensive coverage, the company ensures financial protection and peace of mind for its customers.

- Key Features: Quick quotes, 24/7 support

- Contact Information: alliance-uae.com/

Types of Chevrolet Insurance

Chevrolets are not specifically vulnerable cars but are prone to accidents nonetheless. To provide varying degrees of coverage, there are three main categories of Chevrolet motor insurance available in the UAE:

Comprehensive Chevrolet Car Insurance

Comprehensive car insurance is the most inclusive type of vehicle insurance. It protects against a wide range of incidents in which your Chevy might get involved. It offers full coverage for every Chevy model that you own. If you are looking for maximum protection, this is precisely what you are looking for. This type of insurance covers not only the damages done to your vehicle but also the damages done by your vehicle to other individuals or properties. It covers fire, theft, natural disasters, and car accidents.

Third-Party Liability Chevrolet Insurance

Third-party liability insurance suits people searching for an option that provides minimal and basic coverage. The cost is very economical, but the coverage is not very extensive. In case of an incident, third-party liability insurance will cover damages to another individual or property. Third-party liability insurance will not cover the damages done to your vehicle. It’s worth mentioning that this coverage is mandatory and required by law.

Chevrolet Insurance Add-ons

Sometimes, a comprehensive coverage option isn't enough to meet your specific needs. Consider adding these options to your coverage plan for a more tailored insurance experience:

- Roadside Assistance: Provides help in case of breakdowns, flat tires, or other emergencies while on the road.

- Zero Depreciation Cover: Ensures you receive the full value of your vehicle without depreciation deductions during a claim.

- No Claim Bonus Protection: Allows you to retain your no-claim bonus even if you file a claim during the policy period.

- Consumables Cover: This covers the cost of essential items like engine oil, brake fluid, and other consumables needed during repairs.

These add-ons can help bridge the gap between your insurance needs and what your insurance company offers.

Chevrolet Insurance for Different Models

It’s important to note that each Chevy car model's insurance cost and coverage are different. In this section, we will compare various models.

| Corvette Insurance Cost | A Corvette is considered a luxury sports car, so its insurance cost is typically higher than that of other models. However, costs can be managed by comparing policies and using personalized discounts |

| 2014 Chevy Cruze Insurance Cost | Insurance for older models like the 2014 Chevy Cruze is often more affordable, and that’s because of depreciation. Make sure that your policy covers essential components such as engine protection |

| Chevy Silverado Insurance Cost | Like any other pickup truck, the Silverado requires extensive coverage because of its higher market value and utility. Comprehensive car insurance guarantees full protection when the Silverado is on the road |

| Chevrolet Spark Insurance | Compact cars such as the Chevrolet Spark are known to be budget-friendly, and insurance is also quite affordable. To enhance coverage for this vehicle, you can add features like roadside assistance |

Buy and Renew Chevrolet Insurance Online

The process for purchasing and renewing your Chevy insurance is convenient and fast. Here are the steps to follow to buy your insurance online.

| Visit the Website | Visit Lookinsure’s website and create an account. Enter the details related to your car |

| Get Online Quotes | Use Lookinsure's online quote tool to compare different Chevrolet insurance plans. Lookinsure provides detailed information on each plan, including coverage options and the cost of each plan. Take your time comparing quotes from different insurance providers |

| Complete the Application | Once you’ve decided about your insurance plan, you can complete the online application form with your details. The last step is to pay online via Lookinsure’s secure payment gateway. You can choose to pay in whole or in four installments. Once the payment is made, you will receive confirmation by email |

These are the steps to follow for your insurance plan renewal:

- Visit the Website: Visit Lookinsure’s website and log into your account.

- Select Policy: Choose the policy that needs renewal. Check the previous information and make changes if necessary.

- Confirm Renewal: Confirm your renewal by selecting the coverage options you want. In this step, you might get offers for personalized discounts based on your driving history. The last step is to make the payment online, and then you will receive the confirmation immediately.

Documents Required for Chevrolet Insurance

- Proof of identity (Emirates ID)

- Driver’s license

- Vehicle registration (Mulkiya)

- Previous insurance policy (for your car insurance renewal)

Claim Chevrolet Car Insurance Online with Lookinsure

Claiming insurance with Lookinsure is a straightforward process. You can file a claim through Lookinsure’s website and provide the necessary incident details, evidence, and documentation. Lookinsure will handle the claim process. After getting approval, you will get the compensation you are entitled to.

Chevrolet insurance is essential for protecting your vehicle in the UAE. As a car owner, you can access different types of insurance, such as comprehensive and third-party liability. By comparing the price and options each type of insurance provides, you can choose the coverage that best suits your needs. Lookinsure offers quick online quotes, personalized discounts, and 24/7 customer support. Its job is to make finding the best insurance plan for your Chevrolet easy for you.