Mahindra Insurance: Best Coverage for Your Mahindra Car

Flexible installments to pay later with

And

Regulated by the Government of Dubai

It's been over 45 years since Mahindra has been one of the most well-loved and popular vehicles among UAE citizens. It has a wide presence, and people love it for its comfort, safety, style, and specific technical specifications that are hard to find in other vehicles. Mahindra offers many cars, from electric and small commercial vehicles to buses and trucks. Each year, more and more people in the UAE are inclined to purchase a Mahindra vehicle.

Purchasing a Mahindra car can be an excellent investment due to its reliability and high quality. It's important to remember that when you make such a significant investment, you should ensure that you keep it protected with the most suitable Mahindra insurance. That's where Lookinsure comes into the picture. Lookinsure provides the best auto insurance coverage plans for your Mahindra insurance. No matter what type or model you have, many options are available for your Mahindra car insurance.

Customized Coverages for Mahindra Insurance

Personalized plans for Mahindra vehicle insurance in UAE are exclusive Lookinsure deals with several Mahindra auto insurance coverage types.

Comprehensive Mahindra Insurance

This plan is the one with full insurance comprehensive coverage. It covers you for any vehicle-related incidents, such as road accidents, theft, or even natural disasters. It's a safety net for every scenario or potential risk. With this inclusive insurance solution, you will feel protected on the roads.

Third-Party Mahindra Auto Insurance

Although car insurance third-party is not as comprehensive as full-coverage insurance, it is much more affordable. According to UAE laws, it offers the essential protection that every vehicle needs. Third-party insurance is mandatory if your car injures an individual or damages property.

Mahindra Gap Insurance

The practicality and importance of gap insurance are not lost on insurance buffs. For example, you buy a brand-new Mahindra Thar with a small down payment and a long-term loan. Your vehicle is involved in a severe accident in the first year and is written off. The insurance company's payout is less than the amount you owe on the loan. In this scenario, Mahindra Gap Insurance covers the difference and prevents you from facing financial difficulty.

Add-ons for Mahindra Cars

Many insurance companies forget that each vehicle has specific needs, and options that might be necessary for one vehicle might not be useful for another. It's crucial to consider these differences. Knowing this, Lookinsure offers specific additional items that assist in creating a customizable insurance plan. Here's a list of some of these extra items:

Provides help in emergencies such as breakdowns, flat tires, or fuel delivery. | |

Rental Reimbursement | Covers the cost of a rental vehicle while your car is being repaired after a covered incident. |

Offers financial compensation for injuries or death of the driver and passengers in an accident. | |

Return to Invoice | Ensures you receive the vehicle's original purchase price in case of a total loss. |

Passenger Cover | Provides coverage for injuries to passengers in the vehicle during an accident. |

Tyre Protection | Covers the cost of replacing or repairing tires damaged due to road hazards. |

Offers coverage for repairs or engine replacement due to specific causes or failures. | |

Consumables Cover | Covers the cost of consumables like oil, filters, and lubricants used during repairs. |

Key Replacement Cover | Provides financial assistance for replacing lost or damaged vehicle keys or key fobs. |

You can select the best options that suit your situation and your vehicle's needs.

Cost of Insurance for Popular Mahindra Models in the UAE

The cost varies for each case and depends on different factors. The first factor is the model of your car. Bolero car insurance costs differ from Mahindra Thar or the new Scorpio insurance prices. They all have different price lists. Another factor is the type of coverage you choose, which directly affects the cost of your insurance.

Other factors include the driving experience of the car owner and driving history. For instance, if a car insurance provider knows that you, as a Mahindra motor owner, have never had any road accidents, there is a high chance that you will get a lower price for your Mahindra motor insurance. If you want an accurate price for your Mahindra auto, it's better to check Lookinsure's website. There, you will find all the information you need just by entering the details of your vehicle. Here, we provide an estimated price for some popular Mahindra models in the United Arab Emirates:

Model | Insurance Price (AED) |

Mahindra XUV 500 | AED 1,800 - AED 2,800 |

New Scorpio | AED 1,900 - AED 3,000 |

XUV 700 | AED 2,000 - AED 3,500 |

Mahindra Thar | AED 2,200 - AED 3,200 |

Mahindra Bolero | AED 1,500 - AED 2,400 |

Mahindra TUV300 | AED 1,800 - AED 2,600 |

Buy and Renew Mahindra Auto Insurance Plans with Lookinsure

The easy-to-follow procedures are one of the reasons for Lookinsure's popularity. The website is user-friendly and ensures that tasks are done as quickly as possible. These are the necessary steps for purchasing Mahindra auto insurance:

How to Buy Mahindra Car Insurance?

First, visit the Lookinsure website, enter your vehicle details, compare the different plans available for your vehicle, and select the type of coverage you prefer. Then, complete the purchase by paying online, and you will receive confirmation immediately.

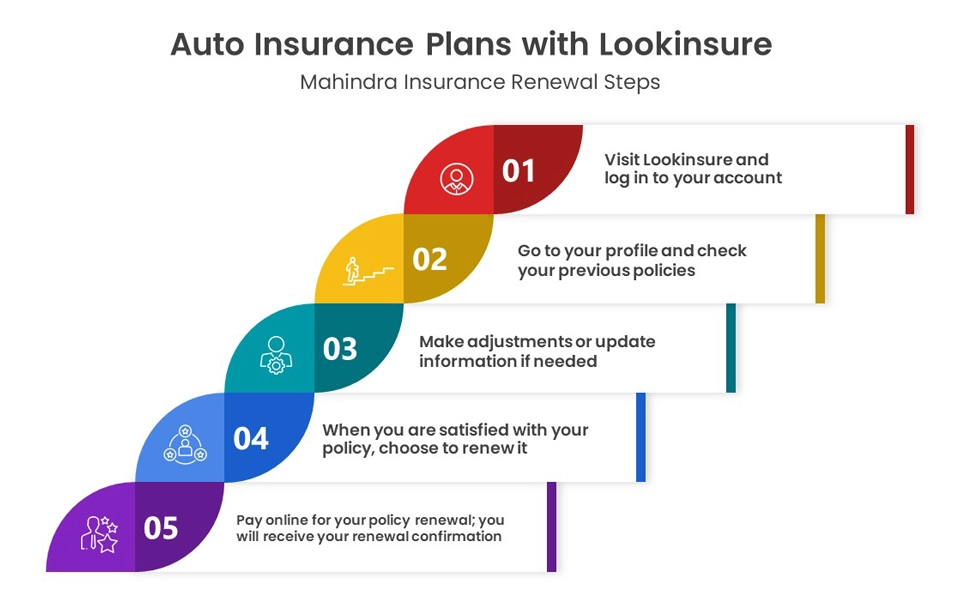

Mahindra Insurance Renewal Steps:

- Visit Lookinsure and log in to your account.

- Go to your profile and check your previous policies.

- Make adjustments or update information if needed.

- When you are satisfied with your policy, choose to renew it.

- Pay online for your policy renewal; you will receive your renewal confirmation.

Top Mahindra Insurance Providers in the UAE

Some of the top insurance providers in the UAE are listed below. These providers can suggest the best solutions for you, you can read more about them on our website:

| AXA Insurance | AXA Insurance in the UAE offers comprehensive, reliable coverage with a focus on customer satisfaction and innovative solutions for individuals and businesses. |

| Oman Insurance Company | Oman Insurance Company provides a wide range of tailored insurance solutions in the UAE, focusing on customer-centric services and financial security. |

| RSA Insurance | RSA Insurance offers flexible and reliable coverage options in the UAE, delivering peace of mind with comprehensive protection for both individuals and businesses. |

How to Claim a Mahindra Car Insurance Policy?

Before providing the guidelines for claiming a policy, we’d like to remind you that in case of an incident, especially a road accident, the most important thing is to check your safety, your passengers, and all parties involved. The steps to claim a policy are as follows:

- Report: Report the incident to your insurance provider after the accident. You should get in touch with them as soon as you can.

- Provide Documents: There are some necessary documents that you need to provide for this procedure, such as your driving license and the police report.

- Submit: Submit your claim form and wait for the experts’ assessment. After the assessment is done, you will have your claim approved.

Documents Required for Mahindra Insurance

Here are the documents you need if you want to purchase Mahindra car insurance:

- A valid Emirates ID

- A valid driving license

- Your vehicle registration card (also known as Mulkiya)

Like any other valuable item that needs protection, your Mahindra Auto demands a good insurance plan to protect you from potential risks. Lookinsure is a wise option for your vehicle because of its reliability and competitive pricing. If you want to drive your Mahindra vehicle with peace of mind, Lookinsure is your go-to insurance company.