Volkswagen Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Volkswagen has established itself as a reliable automotive brand, producing vehicles that blend performance and safety. However, even the most well-engineered cars can face unexpected challenges on the road. Accidents, theft, and damages can happen to any vehicle, making VW car insurance essential for drivers in the UAE.

Finding the right car insurance doesn't have to be complicated if you're a Volkswagen owner in the UAE. Platforms like Lookinsure make comparing VW car insurance quotes simple. With just a few clicks, you can explore various insurance options tailored specifically to your VW model, ensuring you get the best coverage at the most competitive rates.

Volkswagen Car Insurance in the UAE

Owning a Volkswagen in the UAE means your insurance should match the brand’s repair costs and model value. Smaller models like the Polo or Golf often have lower premiums than SUVs like the Tiguan or Touareg. When comparing VW motor insurance, check whether policies cover authorised garages and genuine parts, as this affects both premium and claims. For new cars, comprehensive Volkswagen auto insurance is usually recommended, while older models may benefit from third-party cover with selected add-ons.

Top 5 UAE VW Car Insurance Providers

Here are some of the best companies offering Volkswagon auto insurance policies in the UAE:

GIG (Gulf Insurance Group)

A leading regional insurance provider with a strong reputation for comprehensive coverage, Gulf Insurance offers flexible VW car insurance plans with quick claim processing and competitive rates. Their digital platforms make policy management smooth and convenient for expats.

Sukoon Insurance

A Shariah-compliant insurance provider that offers ethical and transparent insurance solutions. Sukoon Car Insurance in Dubai specializes in personalized car insurance plans that cater to the specific needs of UAE residents, including comprehensive coverage for Volkswagen vehicles.

Dubai Islamic Insurance & Reinsurance (AMAN)

Another leading Shariah-compliant insurer with a strong focus on customer satisfaction. Aman Car Insurance provides comprehensive VW car insurance with flexible payment options and a reputation for fair and efficient claims management.

Emirates Insurance Company

A well-established local insurance provider with a deep understanding of the UAE market. They offer competitive car insurance for Volkswagen plans with quick processing, comprehensive coverage, and localized customer support that understands the unique needs of UAE drivers.

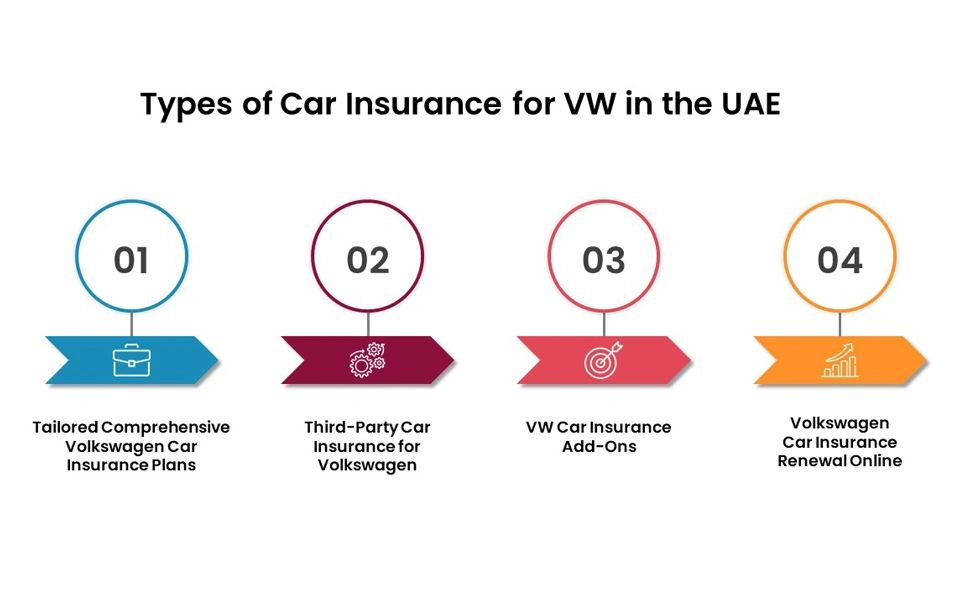

Types of VW Car Insurance in the UAE

Here are the available insurance options that providers in the UAE offer VW owners:

Tailored Comprehensive VW Motor Insurance Plans

Comprehensive motor insurance for VW provides the most extensive protection. These plans typically cover damages resulting from the following causes:

- Accidental damage

- Theft

- Natural disaster damage

- Third-party liability

- Personal accident cover

Third-Party VW Motor Insurance

Third-party insurance is mandatory in the UAE and covers other vehicles and property damages. While more affordable, it provides limited protection for your Volkswagen, making it a better option for older cars only used for work.

VW Car Insurance Add-Ons

Enhance your basic coverage with additional options:

- Roadside assistance: Get help when needed, from breakdowns to flat tires.

- Agency repairs: Ensure repairs are handled by authorized dealerships using genuine parts.

- Personal belongings protection: Safeguard valuable items inside your car from theft or damage.

- Windscreen replacement: Cover the cost of repairs or replacements for damaged windshields.

- Rental car coverage: Stay mobile with a replacement car while yours is in the shop.

What Are Covered and Not Covered Under Volkswagen Motor Insurance?

When you take out Volkswagen motor insurance, it’s important to read the policy carefully. What is covered and what is excluded depends heavily on whether you chose third-party or comprehensive, and which add-ons you included. Always check the terms, excess (deductible), and any special clauses.

What Is Covered

Under most Volkswagen motor insurance comprehensive plans (and with certain add-ons), you typically get:

- Damage to your own vehicle from accidents (whether you are at fault or not)

- Theft of the car, or damage from attempted theft or vandalism Fire damage, natural disasters (e.g. storm, flood, hail)

- Third-party damage: injuries, death, or property damage caused to others due to your vehicle

- Windscreen / glass damage, if included or optionally covered

- Personal accident cover for driver and/or passengers, depending on policy

- Roadside assistance: towing, breakdown help, emergency repair (if added)

What Is Not Covered

Even with a comprehensive Volkswagen auto insurance policy, there are standard exclusions. Things not (or rarely) covered:

- Regular wear and tear, mechanical or electrical failure due to aging parts

- Damage caused by driving under the influence of alcohol or drugs, or while violating traffic laws Intentional damage or illegal use of the vehicle

- Using non-approved spare parts or unauthorized garages (unless agency garage or policy allows)

- Pre-existing damage (damage that existed before the policy)

- Damage when the vehicle is used outside permitted areas (unless policy has GCC or out-of-UAE extension)

Volkswagen Car Insurance Price in UAE

The cost of Volkswagen motor insurance in the UAE varies widely and is influenced by several factors, which we’ll discuss in the next section. As a general rule, the more expensive the car, the higher the premium will be. For example, insuring a Volkswagen SUV will usually cost more than a smaller hatchback like the Polo.

It’s also worth noting that European cars, including Volkswagen, often come with higher insurance costs compared to many Japanese brands, largely because of repair expenses, spare parts, and servicing requirements. Ultimately, your final Volkswagen auto insurance premium depends on a combination of these elements and the type of coverage you choose.

Cheap Volkswagen Car Insurance – How to Save More

Want to lower your Volkswagen auto insurance or Volkswagen motor insurance premium without overly compromising protection? Here are several strategies:

- Choose third-party + essential add-ons rather than full comprehensive if your car is older / depreciated.

- Maintain a clean driving history: no claims, no traffic violations. Insurers reward no-claim discounts.

- Raise the excess (deductible): if you pay more out of pocket in the event of a claim, you often pay lower premiums.

- Limit optional add-ons: only select what you really need (e.g. skip full glass cover or replacement car if too expensive).

- Compare quotes from multiple insurers (or use an aggregator) to make sure you are getting competitive Volkswagen auto insurance.

- Secure garage type: agency vs third party / non-agency garages; agency garages are more expensive.

- Use security features: alarm systems, immobilizers, parking in safe locations reduce risk and give discounts.

- Bundle policies if possible (if insurer offers multi-vehicle, or with other insurance products you have).

Factors Affecting Volkswagen Motor Insurance Premiums

Several factors influence how much your Volkswagen motor insurance or VW motor insurance will cost. Understanding them helps you anticipate pricing and manage it better:

- Vehicle value, model, and engine size: Expensive or high-performance Volkswagen models cost more to insure.

- Age of the vehicle: Newer cars are pricier to cover, while older cars may face higher deductibles or fewer plan options.

- Driver age, experience, and driving record: Young or inexperienced drivers, or those with violations, usually pay higher premiums.

- Type of coverage: Comprehensive insurance and add-ons raise costs compared to basic third-party plans.

- Location / Emirate: Accident rates and repair expenses vary by Emirate, influencing premiums.

- Usage and annual mileage: Cars driven frequently or over long distances are seen as higher risk.

- Security and anti-theft features: Alarm systems and secure parking may reduce premiums.

- Claim history / no-claim bonus: A clean record and no-claim discount help lower insurance costs.

Volkswagen Car Insurance Renewal Online

Renewing your VW car insurance has never been easier. Most insurance providers now offer online renewal platforms where you can simply log into your account and enter your current policy information.

You can do the same on Lookinsure’s website. You can compare quotes, customize your coverage, and renew your policy hassle-free with a few clicks. Our user-friendly interface ensures a smooth experience, saving you time and effort.

Enjoy peace of mind knowing your Volkswagen is protected with the coverage that suits your needs, all while securing competitive rates.

How to Make a Volkswagen Car Insurance Claim?

To file an insurance claim, which is basically why one buys insurance, you must first contact your insurance provider immediately after an incident, report your accident, and then follow the steps below:

- Gather all required documentation

- File a detailed claim report

- Submit photos of damages

- Cooperate with the insurance company's further investigation if needed

Documents Required for VW Car Insurance

The documents required for buying car insurance for Volkswagen are the same as for any other car and include the following:

- Valid UAE driver's license

- Vehicle registration card or Mulkiya

- Passport and residency visa

- No-claims certificate (if applicable)

- Vehicle inspection report

Protecting your Volkswagen in the UAE requires careful consideration of your specific needs. By understanding available options and using platforms like Lookinsure, you can find car insurance solutions that provide peace of mind and comprehensive protection.

How to Buy Volkswagen Auto Insurance Online with Lookinsure

If you want to purchase Volkswagen auto insurance or Volkswagen motor insurance with Lookinsure, here’s a straightforward process:

- Go to the Lookinsure website.

- Enter your personal details (driver’s age, license info, driving history).

- Enter your vehicle’s details: model (Volkswagen), year, engine size, value, etc.

- Indicate the coverage type you want (third-party or comprehensive), and which add-ons you need (windscreen cover, roadside assist, etc.).

- Lookinsure will generate quotes from multiple providers so you can compare offerings.

- Choose the best plan that fits your needs & budget.

- Finalize the policy details (confirm inclusions, excess, duration).

- Make payment online. You’ll receive your policy document / certificate.