ندما يتعلق الأمر بسيارات BMW، تنقسم الآراء. بعض محبي بي إم دبليو يفضلون قيادة سيارة عمرها 10 سنوات على امتلاك أي سيارة جديدة كليًا. هناك بالفعل ما يبرر ولاءهم لهذه العلامة الألمانية الفاخرة. صحيح أن سيارات بي إم دبليو قد تكلف الكثير في الصيانة، لكن كل ما يلزم هو الجلوس خلف محرك V6 مُعتنى به جيدًا لتقع في حبها.

اختيار تأمين سيارة BMW المناسب يمكن أن يساعدك في الحفاظ على السيارة والحصول على خدمات عالية الجودة وقطع غيار أصلية.

تأمين سيارات BMW في الإمارات

الحصول على تأمين سيارة بي إم دبليو المناسب ليس مجرد متطلب قانوني في الإمارات، بل هو خطوة أساسية لحماية استثمارك الثمين. نظرًا للأداء العالي والتقنيات المتقدمة في سيارات بي إم دبليو، فإن وجود وثيقة تأمين متخصصة أمر ضروري. في هذا الجزء سنعرض تفاصيل تأمين سيارات BMW لمساعدتك في العثور على أفضل خطة تأمين شاملة.

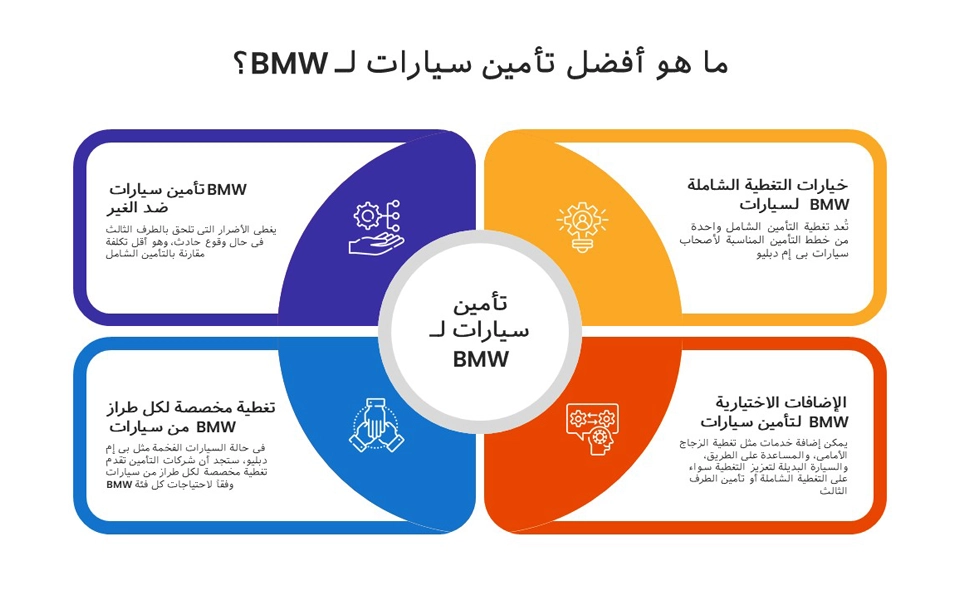

ما هو أفضل تأمين سيارة BMW؟

التأمين الجيد يمنحك راحة البال من خلال ضمان حصول سيارتك على أفضل رعاية ممكنة في حالة وقوع حادث. بالنسبة لمالكي بي إم دبليو، فإن تأمين سيارة بي إم دبليو قد يكون أكثر أهمية، لأنهم يقودون سيارة فاخرة ذات تكلفة صيانة مرتفعة، ما يجعل اختيار التأمين الصحيح أمرًا ضروريًا.

أفضل شركات تأمين سيارات BMW في الإمارات

| شركة التأمين | الوصف |

|---|---|

| شركة آدمجي للتأمين | بالنسبة إلى تأمين سيارة BMW، تُعتبر شركة آدمجي للتأمين خيارًا موثوقًا لمالكي بي إم دبليو في الإمارات. تشتهر بتغطيتها الشاملة وأسعارها التنافسية، كما أنها تدرك الاحتياجات الخاصة لمالكي سيارات BMW. تم تصميم وثائق التأمين لديهم لتوفير أقصى حماية لهذه السيارات الهندسية الدقيقة. |

| شركة دبي الوطنية للتأمين | تقدم شركة دبي الوطنية للتأمين حلولًا متخصصة في تأمين سيارات BMW، حيث تلبي المتطلبات الفريدة لهذه المركبات الفاخرة. سواء كنت تملك BMW 3 Series أو M4، فإن حلولهم التأمينية المصممة خصيصًا توفر تغطية شاملة. خبرتهم العميقة في سيارات BMW تجعلهم من أبرز مزودي تأمين سيارة بي إم دبليو في الإمارات. |

| شركة البحيرة الوطنية للتأمين | توفر شركة البحيرة الوطنية للتأمين بعضًا من أكثر خيارات التغطية شمولاً لتأمين سيارات BMW مثل M3. فهم يدركون أن مالكي BMW يحتاجون إلى أكثر من مجرد حماية أساسية، بل إلى وثيقة تأمين تتماشى مع مستوى تطور سياراتهم. |

| شركة سلامة للتكافل | تقدم شركة سلامة للتكافل حلولًا مبتكرة في تأمين سيارات BMW، حيث تمزج بين التغطية التقليدية والمرونة الحديثة. وثائقهم الخاصة بـ BMW Mini مميزة بشكل خاص، إذ تمنح حماية شاملة للنماذج الأصغر. |

| شركة أبوظبي الوطنية للتكافل | تُعد شركة أبوظبي الوطنية للتكافل من أبرز مزودي تأمين سيارة بي إم دبليو المتخصص. تم تصميم وثائقهم لتوفير راحة البال لمالكي BMW، وتشمل كل شيء من الخدوش البسيطة وحتى الإصلاحات الكبيرة. |

أنواع خطط تأمين سيارات BMW في الإمارات

إليك نظرة على أهم خيارات تأمين سيارة BMW المتاحة:

التأمين الشامل لسيارات BMW

عند اختيار تأمين سيارة بي إم دبليو، فإن التأمين الشامل ضروري. أفضل وثائق تأمين سيارات BMW تتجاوز الحماية الأساسية، وتشمل:

حماية كاملة ضد الأضرار الناتجة عن الحوادث

تغطية لقطع الغيار المتخصصة في BMW

حماية من السرقة والكوارث الطبيعية

تغطية عالمية عند السفر الدولي

تأمين المسؤولية تجاه الغير لسيارات BMW

رغم أن التأمين الشامل هو الخيار الأمثل، إلا أن تأمين الطرف الثالث أيضًا خيار مناسب. هذا النوع من تأمين سيارة BMW يمنحك الحماية القانونية والمالية ضد المخاطر الناتجة عن الحوادث مع الغير. لكن يجب ملاحظة أن هذا التأمين لا يغطي الأضرار التي قد تلحق بسيارتك.

الإضافات المتاحة مع تأمين سيارة BMW

بما أن سيارات بي إم دبليو أحيانًا تكون عالية التكلفة في الصيانة، فإن اختيار الإضافات المناسبة ضمن تأمين سيارة BMW يمكن أن يحمي استثمارك بشكل أكبر:

| الخيار | الوصف |

|---|---|

| تغطية من دون استهلاك | تضمن لك الحصول على التكلفة الكاملة لاستبدال الأجزاء البلاستيكية والمطاطية والألياف الزجاجية دون خصم الاستهلاك. |

| حماية المحرك | في وثائق التأمين العادية، لا تُغطى أعطال المحرك الناتجة عن تسرب الزيت أو دخول الماء إلا إذا كانت بسبب حادث. هذا الخيار يغطي أعطال المحرك ومكوناته الداخلية. |

| المساعدة على الطريق | سيارات BMW القديمة ممتعة في القيادة لكنها قد تتعرض للأعطال. هذا الخيار يوفر سحب مجاني ويجعل المواقف الطارئة أسهل بكثير. |

| توفير سيارة بديلة أثناء الإصلاح | نظرًا لأن إصلاح BMW قد يستغرق وقتًا أطول بسبب تعقيدها الميكانيكي، فإن هذا الخيار يضمن لك الحصول على سيارة بديلة مجانية أثناء وجود سيارتك في الورشة. |

سواء كنت تقود كوبيه رياضية أو سيدان فاخرة، فإن لوکینشور تجعل من السهل العثور على أفضل خطة تأمين سيارات BMW تناسب قيمة سيارتك واستخدامك. ولا تدع التكاليف تمنعك من الحماية الكاملة، إذ يمكنك مع لوکینشور الحصول على تأمين سيارة بي إم دبليووالدفع عبر تمارا بأقساط ميسرة وبدون فوائد.

ما يتم تغطيته وما لا يتم تغطيته في تأمين سيارة BMW

فهم ما يشمله وما يستثنيه التأمين هو المفتاح لتجنب التكاليف غير المتوقعة. وثيقة تأمين سيارة بي إم دبليو القياسية مصممة لحمايتك ماليًا، لكنها لا تغطي كل السيناريوهات. لذلك من الضروري قراءة الشروط بعناية لضمان الحصول على أفضل تأمين سيارات BMW يلبي احتياجاتك الخاصة.

ما يتم تغطيته عادةً

إصلاحات الحوادث: تغطي تكاليف إصلاح سيارة BMW بعد الحوادث، غالبًا في ورش معتمدة من الوكالة للحفاظ على الضمان والجودة.

المسؤولية تجاه الغير: توفر الحماية إذا كنت المتسبب في حادث أدى إلى إصابة أشخاص آخرين أو إتلاف ممتلكاتهم، وهو إلزامي بموجب قانون الإمارات.

الحريق والسرقة: تعويض مالي في حال سرقة سيارتك أو تعرضها للتلف بسبب الحريق أو الانفجار.

الكوارث الطبيعية: تغطية الأضرار الناتجة عن الفيضانات أو العواصف أو البَرَد (تتوفر كخيار إضافي).

التخريب: تشمل إصلاح الأضرار إذا تعرضت سيارتك للتخريب المتعمد من طرف آخر.

ما لا يتم تغطيته عادةً

الاستهلاك والتآكل: مثل تآكل الإطارات أو الفرامل أو الدواسات، غير مشمول في أي وثيقة تأمين سيارة BMW.

الأعطال الميكانيكية أو الكهربائية: الأعطال الناتجة عن الاستخدام العادي تعتبر مسائل صيانة وليست مغطاة.

القيادة من دون رخصة سارية: أي حادث يقع أثناء القيادة بدون ترخيص قانوني لا يغطيه التأمين.

الإصلاحات غير المصرح بها: إصلاح السيارة في ورشة غير معتمدة بدون موافقة شركة التأمين قد يلغي التغطية.

القيادة خارج الطرق المصرح بها: الأضرار الناتجة عن القيادة في الطرق غير الممهدة عادة غير مشمولة ضمن أفضل وثائق تأمين سيارات BMW.

أسعار تأمين سيارة BMW في الإمارات

تكلفة تأمين سيارة بي إم دبليو ليست رقمًا ثابتًا، بل يتم تحديدها وفقًا لعوامل تقييم المخاطر. بشكل عام، أقساط التأمين الشامل على سيارات BMW قد تتفاوت بشكل كبير. فهم هذه العوامل هو الخطوة الأولى للحصول على أفضل تأمين سيارات BMW بسعر تنافسي.

تأمين سيارات BMW رخيص – كيف توفر أكثر؟

العثور على تأمين ميسور التكلفة لا يعني التضحية بالجودة. هناك عدة طرق لخفض القسط السنوي مع الحفاظ على حماية قوية:

مقارنة الأسعار عبر الإنترنت: استخدم منصات مثل لوکینشور لمقارنة عروض متعددة والعثور على أفضل تأمين سيارة BMW بأقل سعر.

زيادة نسبة التحمل: دفع مبلغ أكبر عند المطالبة يمكن أن يخفض القسط السنوي.

تركيب أجهزة أمان معتمدة: مثل أنظمة التتبع أو الإنذارات، مما يقلل من احتمالية السرقة ويمنح خصومات.

اختيار مستوى تغطية أقل: إذا كانت سيارتك قديمة، يمكنك الاكتفاء بتأمين ضد الغير مع الحريق والسرقة بدلًا من التأمين الشامل.

الحفاظ على سجل قيادة نظيف: عدم ارتكاب مخالفات أو التورط في حوادث يقلل من تقييم المخاطر ويؤدي إلى الحصول على أفضل سعر في تأمين سيارات BMW.

العوامل المؤثرة على أقساط تأمين سيارة BMW

شركات التأمين تحدد تكلفة تأمين سيارة بي إم دبليو وفقًا لمجموعة معايير، منها:

طراز السيارة وحجم المحرك: سيارات مثل BMW M5 أو X6 M لها أقساط أعلى من BMW 1 Series بسبب ارتفاع تكاليف الإصلاح.

عمر السائق وخبرته: السائقون الأصغر سنًا أو قليلو الخبرة يدفعون أكثر.

سجل المطالبات: السائقون بسجل نظيف يحصلون على أقساط أقل.

قيمة السيارة وعمرها: السيارات الجديدة تكلف أكثر من القديمة.

نوع التغطية: التأمين الشامل (الأفضل لسيارات BMW) أغلى من تأمين الطرف الثالث.

مكان السكن: المناطق ذات الكثافة المرورية أو معدلات الجريمة المرتفعة تؤثر على السعر.

عدد الكيلومترات المقطوعة سنويًا: الاستخدام المكثف يزيد من المخاطر.

مستوى الأمان: تركيب أنظمة ضد السرقة يمكن أن يقلل من القسط.

كيفية شراء تأمين سيارة BMW عبر لوکینشور

أصبح الحصول على أفضل تأمين سيارات BMW أسهل من أي وقت مضى:

ادخل إلى موقع لوکینشور الإلكتروني.

أدخل بياناتك الأساسية ومعلومات سيارتك BMW.

استلم عروضًا متعددة من شركات التأمين.

قارن بين الخيارات وحدد الأنسب لك.

أكمل تفاصيل الوثيقة وادفع عبر الإنترنت.

استلم وثيقة التأمين على بريدك الإلكتروني فورًا.

تجديد تأمين سيارة BMW عبر الإنترنت

لم يعد تجديد وثائق تأمين سيارة بي إم دبليو أمرًا معقدًا. يمكنك الآن التجديد بسهولة عبر الإنترنت:

الدخول إلى موقع لوکینشور

تسجيل الدخول إلى حسابك

اختيار وثيقتك الحالية

مراجعة التفاصيل وتأكيدها

إتمام الدفع عبر الإنترنت

كيفية تقديم مطالبة تأمين سيارة BMW

الغرض الأساسي من التأمين هو الحماية عند الحاجة. لتقديم مطالبة على تأمين سيارات BMW:

تواصل مع شركة التأمين مباشرة بعد الحادث.

جهّز المستندات المطلوبة.

قدم تقرير مطالبة مفصل.

أرسل صور الأضرار.

تعاون مع شركة التأمين أثناء التحقيقات.

المستندات المطلوبة لتأمين سيارة BMW

عند التقديم للحصول على تأمين سيارة BMW في الإمارات، يجب تقديم المستندات التالية سواء كنت تشتري وثيقتك عبر الإنترنت أو بشكل مباشر:

تسجيل السيارة

نسخة من بطاقة تسجيل السيارة (المعروفة باسم الملكية "Mulkiya" في الإمارات) إلزامية. هذا المستند يثبت ملكية السيارة ويُطلب من جميع شركات التأمين.

رخصة القيادة

من المتطلبات أيضًا وجود رخصة قيادة سارية في الإمارات. بعض شركات التأمين قد تطلب رخصة قيادة دولية أو رخصة محلية محوّلة للمقيمين الأجانب.

بطاقة الهوية الإماراتية

بطاقة الهوية الإماراتية ضرورية لإثبات الهوية. بعض شركات التأمين تقبل أيضًا تطبيق UAE PASS كبديل لطلبات التأمين عبر الإنترنت بشكل أسرع.

شهادة عدم وجود مطالبات (إن وُجدت)

إذا كان لديك سجل خالٍ من المطالبات، فإن تقديم شهادة عدم وجود مطالبات من شركة التأمين السابقة قد يؤهلك للحصول على خصومات، مما يساعد في تقليل قسط تأمين سيارة بي إم دبليو.

مستندات إضافية (لحالات محددة)

للسيارات الممولة: خطاب من البنك الممول يؤكد تفاصيل السيارة.

للسيارات التابعة للشركات (أسطول): قد تكون هناك حاجة إلى مستندات تسجيل الشركة وخطابات تفويض.

إعداد هذه المستندات يضمن عملية سلسة عند التقديم أو تجديد تأمين سيارات BMW في الإمارات.

اختيار تأمين سيارة BMW المناسب

اختيار تأمين سيارة بي إم دبليو الصحيح ليس مجرد مسألة سعر، بل يتعلق بالحماية الشاملة، والخدمات المتخصصة، وراحة البال. من خلال فهم خياراتك واختيار مزود يفهم تفاصيل تأمين سيارات BMW، يمكنك الاستمتاع بقيادة سيارتك بثقة.