لا يمكن لأي مالك سيارة أن ينكر أن امتلاك تأمين سيارة جيد يمنح راحة بال لا تُقدّر بثمن. ومع ذلك، هناك أنواع من التغطيات قد يتم تجاهلها أحيانًا عند شراء التأمين عبر الإنترنت، مثل تغطية الممتلكات الشخصية داخل السيارة. فهل فكرت يومًا: هل يغطي تأمين السيارة الممتلكات الشخصية في حال فقدانها أو تلفها؟

ماذا لو تعرض جهازك المحمول أو حاسوبك للتلف في حادث مروري، أو تمت سرقة حقيبتك من السيارة؟ لتجنّب مثل هذه الخسائر، تقدم بعض شركات التأمين خيارًا إضافيًا يعرف باسم تأمين الممتلكات الشخصية.

لماذا تختار لوکینشور لتأمين الممتلكات الشخصية؟

تعد لوکینشور من أفضل الخيارات سواء كنت تشتري بوليصة تأمين جديدة أو ترغب بإضافة تغطية الممتلكات الشخصية إلى تأمينك الحالي، لأنها تجمع بين توفير الوقت والتكلفة المناسبة. إليك الأسباب التي تجعلها الأفضل:

تغطية شاملة

توفر لوکینشور خيار تأمين الممتلكات الشخصية كإضافة مميزة لتعزيز الحماية الكاملة لمقتنياتك أثناء السفر بسيارتك. ويعتبر تأمين شامل، حيث تشمل هذه التغطية حماية الأغراض الشخصية مثل الأجهزة الإلكترونية والحقائب والأدوات الثمينة ضد التلف أو الفقدان الناتج عن الحوادث أو السرقة أو التخريب. بهذا الشكل، تضمن أن ممتلكاتك الشخصية مؤمّنة تمامًا ضمن تغطية الممتلكات الشخصية في حال وقوع أي حادث غير متوقع.

أسعار مناسبة

تتميز لوکینشور بتقديم أسعار تنافسية لتغطية تأمين الممتلكات الشخصية بفضل شراكاتها الاستراتيجية مع شركات تأمين متعددة وخدمات الدفع بالتقسيط. كما تحرص على توفير عروض مرنة تناسب جميع الفئات، بحيث يمكن لأي مالك سيارة الحصول على تغطية الممتلكات الشخصية دون زيادة كبيرة في تكلفة التأمين الأساسية.

مرونة تركّز على العميل

تتبنّى لوکینشور نهجًا مرنًا يركز على احتياجات العميل، حيث تتيح إضافة وتخصيص خيارات التأمين بسهولة لتناسب متطلباتك الشخصية. من خلال الاستماع لملاحظات العملاء وتطوير الخدمات بناءً عليها، تمنح الشركة شعورًا بالثقة والراحة لكل من يبحث عن تأمين الممتلكات الشخصية يلائم احتياجاته اليومية.

تخصيص معزّز

تمنح لوکینشور العملاء حرية تخصيص تغطية الممتلكات الشخصية حسب طبيعة مقتنياتهم داخل السيارة. فلكل شخص احتياجات مختلفة، وهذه الخدمة مصممة لتناسب كل عميل بطريقة فريدة، سواء كانت مقتنياتك إلكترونية، أو حقائب عمل، أو معدات تصوير احترافية.

ما هو تأمين فقدان الممتلكات الشخصية في السيارة؟

الآن، دعونا نتعمّق أكثر في تفاصيل تأمين الممتلكات الشخصية ضمن بوليصة تأمين السيارة. إذا كنت من الأشخاص الذين يحتفظون بأغراضهم الشخصية داخل السيارة بشكل دائم، فمن المهم أن تعرف ما هي الأشياء التي يمكن أن يشملها هذا النوع من تغطية الممتلكات الشخصية عند شراء التأمين عبر الإنترنت.

الخدمات التي تشملها تغطية الممتلكات الشخصية

عند إضافة تأمين الممتلكات الشخصية إلى بوليصة تأمين السيارات، فإن التغطية تشمل عادة ما يلي:

السرقة: إذا تم اقتحام سيارتك وسرقة متعلقاتك مثل الأجهزة أو الحقائب أو النظارات الشمسية، فسيغطي التأمين تكاليف استبدالها.

الأضرار الناتجة عن السرقة: يغطي التأمين التلف الذي قد يلحق بمقتنياتك أثناء محاولة السرقة.

الضرر الناتج عن الحريق أو الحادث: إذا تعرضت أغراضك للتلف بسبب حريق أو حادث مروري، فإن تغطية الممتلكات الشخصية تشمل تعويضك عنها.

تغطية الأغراض مرتفعة القيمة: تسمح بعض الشركات بإدراج عناصر محددة باهظة الثمن مثل الكاميرات الاحترافية أو الأجهزة المحمولة ضمن التأمين.

ملاحظة: يجب تأمين السيارة بشكل صحيح عند تفعيل تغطية الممتلكات الشخصية. فإذا كانت السيارة غير مقفلة أو النوافذ مفتوحة وقت السرقة، قد ترفض شركة التأمين المطالبة. كما يجب تقديم دليل كافٍ على واقعة السرقة أو الضرر عند المطالبة بالتعويض.

الاستثناءات والقيود في تغطية الممتلكات الشخصية

مثل أي بوليصة تأمين، فإن تغطية الممتلكات الشخصية داخل السيارة لها بعض الحدود والاستثناءات التي يجب أن يعرفها كل مالك سيارة. فهم هذه البنود يُساعدك على تجنّب أي مفاجآت أثناء تقديم المطالبة. إليك أبرز هذه الاستثناءات:

النقود وبطاقات الائتمان: عادةً لا يشمل تأمين الممتلكات الشخصية تعويض المبالغ النقدية أو بطاقات الائتمان المسروقة.

المقتنيات الظاهرة: بعض الشركات ترفض التعويض في حال ترك الأغراض الثمينة بشكل واضح على المقاعد، إذ يُعتبر ذلك إهمالًا يشجع السرقة.

حدود التعويض: هناك حد أقصى للتعويض عن كل غرض منفصل، وحد إجمالي لكل المطالبات في الحادث الواحد. لذلك من المهم قراءة وثيقة تغطية الممتلكات الشخصية جيدًا قبل الاشتراك بها.

لماذا تختار تأمين السيارة مع تغطية الممتلكات الشخصية في الإمارات؟

يحمل كثير من الناس مقتنيات ثمينة داخل سياراتهم ، مثل الحاسوب المحمول، أو مشتريات جديدة، أو أدوات رياضية، مما يجعل إضافة تأمين الممتلكات الشخصية خيارًا عمليًا وذكيًا للغاية. السبب الأهم لإضافة هذه التغطية هو الحماية من السرقة. فإذا تعرّضت سيارتك للاقتحام وسُرقت منها متعلقاتك، فإن تغطية الممتلكات الشخصية تمنحك تعويضًا ماليًا لتقليل الخسائر.

كما تشمل التغطية الأضرار الناتجة عن تسرب المياه داخل السيارة أو تلف الحقيبة بسبب حادث. يطرح العديد من الأشخاص سؤالًا شائعًا: هل يغطي تأمين السيارة الممتلكات الشخصية؟ والإجابة هي: لا، إلا إذا أضفت هذا الخيار بشكل صريح إلى وثيقتك. ولهذا السبب يُنصح دائمًا بشراء تأمين الممتلكات الشخصية كإضافة أساسية لأي بوليصة تأمين في الإمارات.

كيفية إضافة تغطية الممتلكات الشخصية عبر لوکینشور

في هذا القسم، سنتعرف على الخطوات التي يجب اتباعها لإضافة تأمين الممتلكات الشخصية إلى وثيقتك عبر منصة لوکینشور

الخبر الجيد أن العملية سهلة وسريعة للغاية مثل جميع خدمات المنصة الأخرى.

راجع وثيقتك الحالية: تحقق أولًا مما إذا كانت بوليصتك تتضمن تغطية الممتلكات الشخصية بالفعل. إذا لم تكن مضافة، ستحتاج إلى اختيارها كخيار إضافي.

اختيار الإضافة المناسبة: اختر الإضافة التي تتوافق مع احتياجاتك اليومية. تأكد من قراءة التفاصيل الدقيقة، خاصة بنود الاستثناءات وحدود التعويض.

احصل على عروض الأسعار: عبر لوکینشور يمكنك إدخال تفاصيل سيارتك واختيار التغطيات المطلوبة لتظهر لك العروض المقارنة فورًا.

قارن بين الشركات: يتيح لك النظام المقارنة بين شركات التأمين المختلفة، حيث قد تختلف في المميزات مثل حدود المطالبات أو عدد الاستثناءات.

تأكيد التغطية: بعد اختيار العرض المناسب، أضف تغطية الممتلكات الشخصية إلى بوليصتك واحتفظ بنسخة منها للرجوع إليها لاحقًا.

كيف تحصل على تأمين ممتلكات شخصية بسعر مناسب؟

من السهل جدًا العثور على تأمين الممتلكات الشخصية بسعر منخفض باتباع بعض الخطوات البسيطة:

قارن بين الشركات: تختلف الأسعار من شركة إلى أخرى، لذا من المهم مقارنة العروض قبل الشراء.

اضبط نسبة التحمل: رفع نسبة التحمل (المبلغ الذي تدفعه بنفسك عند المطالبة) يقلل من قيمة القسط الشهري.

اختر التغطية التي تحتاجها فقط: إذا كنت لا تحمل أغراضًا باهظة الثمن باستمرار، يمكنك اختيار حد تغطية أقل لتقليل التكلفة.

اسأل عن العروض المجمّعة: بعض الشركات تقدم خصومات عند شراء إضافتين معًا، مثل تغطية الممتلكات الشخصية مع تغطية استبدال مفتاح السيارة.

تكلفة تأمين الممتلكات الشخصية في الإمارات وتأثيرها على القسط

يُعد تأمين الممتلكات الشخصية من الإضافات منخفضة التكلفة التي يمكن ضمها إلى تأمين السيارة. فزيادة القسط السنوي عادةً تكون بسيطة جدًا مقارنة بقيمة المقتنيات التي تحميها. تختلف التكلفة حسب الحد الأقصى للتغطية الذي تختاره. على سبيل المثال:

تغطية بقيمة 5,000 درهم إماراتي تكون أقل تكلفة من تغطية بقيمة 10,000 درهم إماراتي. إنه استثمار صغير مقابل حماية نفسك من خسارة كبيرة، مثل فقدان حاسوبك المحمول أو أدواتك الثمينة داخل السيارة. لذلك، إضافة تأمين الممتلكات الشخصية تمنحك راحة بال حقيقية.

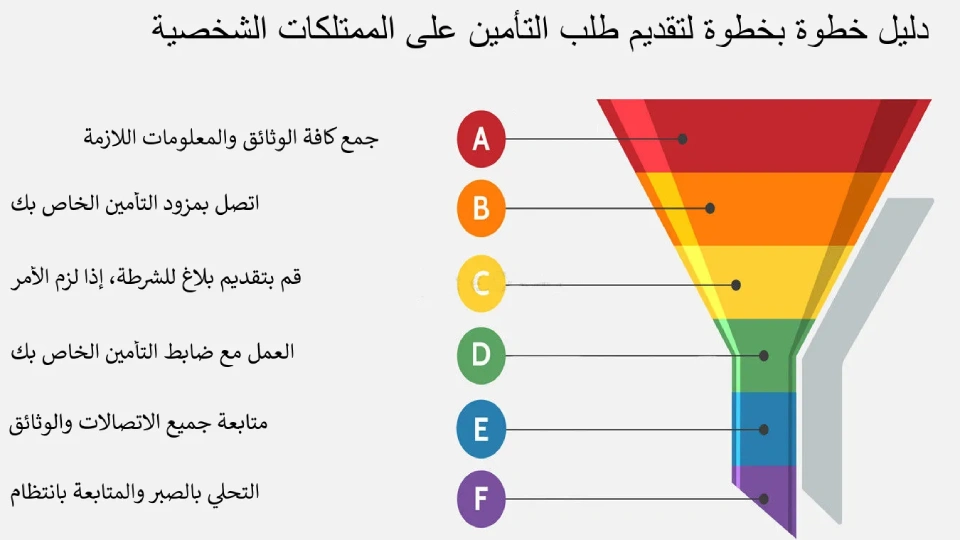

كيفية تقديم مطالبة لتعويض فقدان الممتلكات الشخصية

عند فقدان أغراضك داخل السيارة أو تعرضها للتلف، يمكنك المطالبة بتعويض ضمن تغطية الممتلكات الشخصية باتباع الخطوات التالية:

إبلاغ شركة التأمين فورًا: بعد الحادث مباشرة، تواصل مع الشركة وقدّم جميع التفاصيل المطلوبة.

تقديم بلاغ للشرطة (إن لزم): في حال كانت هناك سرقة، يجب تقديم بلاغ رسمي للحصول على تقرير شرطة يثبت الواقعة.

إثبات الملكية: قدم فواتير الشراء أو أي دليل يثبت ملكيتك للأغراض المسروقة أو التالفة.

استكمال استمارة المطالبة: عبّئ النموذج المطلوب وأرفق جميع المستندات اللازمة.

المستندات المطلوبة لتأمين الممتلكات الشخصية

لتسريع عملية التعويض ضمن تأمين الممتلكات الشخصية، عليك تجهيز المستندات التالية:

نسخة من وثيقة تأمين السيارة

تقرير الشرطة (في حال السرقة)

إثبات الملكية أو فواتير الشراء للأغراض المتضررة

استمارة المطالبة مكتملة البيانات

نصيحة: من الأفضل الاحتفاظ بصور أو فيديوهات لمقتنياتك داخل السيارة. فوجود أدلة واضحة يُسهل عملية قبول المطالبة وتسريعها.

ختامًا.. نسمع كثيرًا عن حالات فقدان ممتلكات ثمينة مثل الحواسيب المحمولة أو المجوهرات من السيارات. لذلك، من الحكمة التفكير جديًا في الحصول على تغطية الممتلكات الشخصية ضمن تأمين سيارتك. فهي ليست مجرد إضافة، بل حماية ذكية لأغراضك اليومية. ومع لوکینشور، ستجد دائمًا أفضل عروض تأمين الممتلكات الشخصية في الإمارات بأقل الأسعار وأعلى جودة ممكنة.