Land Rover Car Insurance in UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Having a Land Rover car is considered a good investment in the UAE. Just like many other investments, your Land Rover also needs protection. Suitable car insurance will fulfill legal requirements and offer peace of mind by financially supporting you against various incidents, such as car accidents, theft, vandalism, fire, and more.

Here, we will provide details related to Land Rover car insurance aspects. This includes the main types of coverage, factors affecting Land Rover insurance costs, and tips to compare car insurance and find the best insurance plan for your Land Rover. By the end of this guide, you will clearly understand how to select the best coverage plan for your Land Rover.

Types of Land Rover Insurance

Comprehensive Land Rover Car Insurance

As the name suggests, this type of insurance provides the most comprehensive coverage for your Land Rover car. It will financially support you against many incidents, such as accidents, fire, vandalism, and natural disasters, so it is worth to buy car insurance with comprehesnive coverage.

Third-Party Land Rover Insurance

Third-party car insurance is a must for each vehicle because it’s legally mandatory. It provides support in case your car injures an individual or damages a property. It’s important to remember that this type of coverage will not financially protect your own vehicle if an incident happens; it only focuses on third parties.

Classic Land Rover Insurance

If you own a vintage Land Rover, this is the ideal coverage for your vehicle. This type of insurance considers classic cars' unique value and specific needs. It usually offers specialized coverage, including agreed value policies, restoration protection, and protection against devaluation.

Land Rover Insurance Add-ons

Sometimes, what you need for your Land Rover insurance cannot be found in any of the main types of coverage provided by your insurer. That’s why Land Rover Insurance Add-ons exist. You can add various add-ons to your policy to provide additional coverage. Some popular add-ons include:

Insurance Type | Description |

Provides help in case of a breakdown, including services like towing, tire changes, and fuel delivery. | |

Offers financial protection for medical expenses or compensation in the event of injury or death. | |

Extends insurance protection for vehicles used on unpaved roads or rugged terrains. | |

No-Claims Discount Protection | Allows policyholders to retain their no-claims discount even if they file a claim during the policy term. |

Zero Depreciation Cover | Ensures that the policyholder is compensated for the full value of a vehicle without considering depreciation. |

Consumables Cover | Covers the cost of essential items like engine oil, brake fluids, and other consumables in the event of a claim. |

Land Rover Defender Insurance

Specific Coverage for the Land Rover Defender

The Land Rover Defender is an off-road vehicle that requires specific coverage. Land Rover Defender insurance provides specifically designed policies that match the unique needs of this Land Rover model.

Land Rover Defender Car Insurance Cost

The cost of Land Rover Defender car insurance can vary based on factors such as the driver's age, vehicle usage, and driving history. All these factors will be considered. The best way to find out about the range of prices for your Land Rover Defender is to compare quotes from different insurers.

Tips for Reducing Land Rover Insurance Cost

In this section, we provide you with a list of strategies with which you can find cheap car insurance in UAE for your Land Rover. The list includes:

- Compare Quotes: Compare quotes from different insurance providers. This will help you determine what you want to include or exclude from your insurance policy and ensure a tailored policy that covers only what you want.

- Keep a Clean Driving Record: Having a clean driving record indicates that you are a low-risk driver, and the chance of getting into a car accident is lower for you. Insurance providers appreciate drivers who have clean records and drive safely. That’s why a clean driving history can lead to lower premiums.

- Take Advantage of No-Claims Discounts: Many insurance providers promise discounts if the insurance holders have a no-claims history. You can use this and build a no-claim history to reduce future premiums.

- Bundle Policies: Another good way to get discounts on your insurance is to combine your car insurance with other policies. For example, you can combine your car insurance with your home insurance.

Finding Cheap Land Rover Insurance

It takes careful consideration and research to find cheap Land Rover insurance. The process can be time-consuming sometimes unless you use specific user-friendly tools like those provided by Lookinsure. Lookinsure's platform gives you access to tools that make your research faster and more convenient. This platform makes it easy to compare quotes from various insurance providers and find the best deals for your Land Rover.

Top Land Rover Insurance Providers

Here are some of the top Land Rover insurance providers in the UAE:

Orient Insurance

Focusing on comprehensive insurance solutions, Orient Insurance provides various products, including life, health, auto, and property insurance. The company is recognized for its customer-focused approach and innovative policies, guaranteeing financial protection through customized insurance plans.

Oriental Insurance

Oriental Insurance is a reputable provider in the UAE. It is dedicated to delivering various insurance services, including general and specialized products. With a strong emphasis on customer satisfaction and a robust network, Oriental Insurance provides reliable coverage designed to meet diverse needs.

Dubai Insurance

Established in 1970, Dubai Insurance Company is one of the leading providers in the region. It offers a diverse portfolio that includes motor, health, and property insurance. Known for its strong financial performance and commitment to policyholder service, Dubai Insurance aims to protect individuals and businesses with trustworthy coverage.

Al Sagr Insurance

Al Sagr Insurance is a prominent insurer in the UAE. It specializes in general insurance products for individuals and businesses. Focusing on risk management and customer support, Al Sagr strives to provide comprehensive solutions and expert advice to help clients safeguard their assets.

These insurance companies offer a range of policies designed for the needs of your Land Rover vehicle. They ensure comprehensive protection and high-quality customer service.

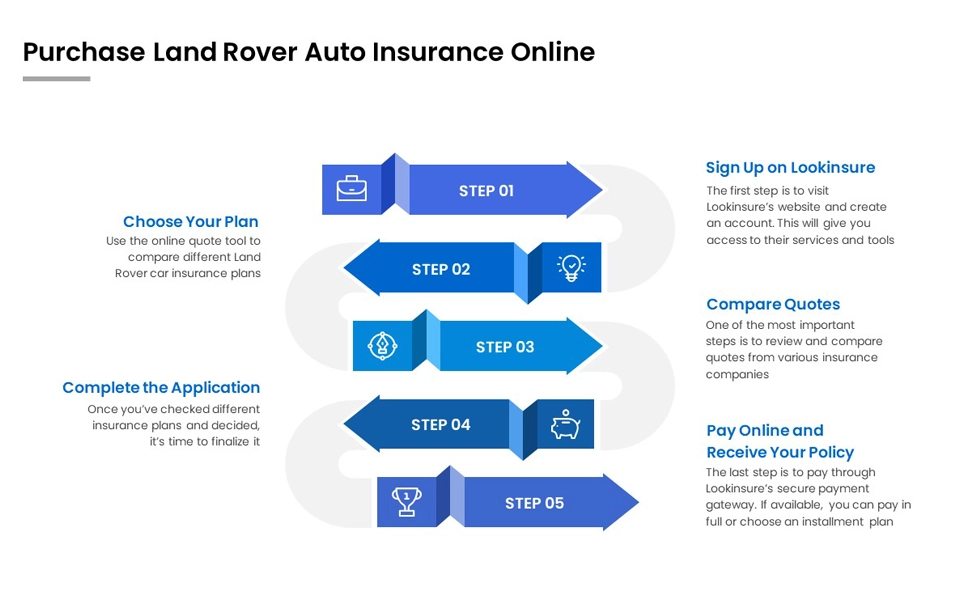

Buy Land Rover Car Insurance Online

Purchasing your Land Rover Car Insurance is more convenient than you can imagine. Lookinsure provides an easy-to-use platform where you can complete these tasks with just a few clicks. These are the steps to follow:

Sign Up on Lookinsure

The first step is to visit Lookinsure’s website and create an account. This will give you access to their services and tools.

Choose Your Plan

Use the online quote tool to compare different Land Rover car insurance plans. Lookinsure offers detailed information on each plan, including coverage options and costs.

Compare Quotes

One of the most important steps is to review and compare quotes from various insurance companies. Lookinsure helps you make an informed decision by offering transparent details about each plan. Remember to check the exclusions and inclusions of each insurance plan, as they can be very different.

Complete the Application

Once you’ve checked different insurance plans and decided, it’s time to finalize it. To do that, you must complete the online application form with your personal and vehicle details.

Pay Online and Receive Your Policy

The last step is to pay through Lookinsure’s secure payment gateway. If available, you can pay in full or choose an installment plan. Once the payment is made, you will receive your policy confirmation via email.

Renew Land Rover Insurance Online

The renewal process for your Land Rover car insurance is also straightforward. These are the steps for your insurance renewal:

Log In to Lookinsure

Visit Lookinsure’s website and log in to your account.

Select Policy for Renewal

In this step, you must look for the “My Policy” section and select the policy you want to renew.

Review and Update Information

Once you’ve selected the policy that needs renewal, review it to ensure the information is updated. If applicable, edit and change the details before proceeding to the next step.

Confirm Renewal

Once you’ve ensured that your policy is updated and doesn’t need any alterations, confirm your renewal by selecting the coverage options you need. Lookinsure may offer personalized discounts based on your driving or no-claims history.

Make Payment and Receive Confirmation

The last step is to make the payment online. Once you make the payment, you will receive confirmation via email, so enter your email address correctly.

Documents Required for Land Rover Car Insurance

To buy or renew your Land Rover car insurance, you will need the following documents:

- Vehicle information (e.g., vehicle registration number)

- Driver's license

- Valid passport

- Proof of address

- Previous insurance policy (for renewals)

File a Land Rover Insurance Claim on Lookinsure

Filing a claim with Lookinsure is straightforward. The first thing to remember is that you need to notify your insurance provider about the incident immediately. After that, they will ask you for the necessary documents, such as a police report or photographs of the damage. You can submit your claim online or through their customer service team. Once you submit the claim, Lookinsure will handle the process and ensure you receive the compensation you are entitled to.

Land Rover car insurance is essential for ensuring your financial security in the future. With various types of insurance available, such as comprehensive and third-party liability, you, as the car owner, can choose the coverage that best suits your needs. Lookinsure’s platform offers a user-friendly space with practical tools to make insurance-related processes as easy and quick as possible. Lookinsure helps you find the best insurance plan for your Land Rover.

Frequently Asked Questions

Answers to common questions about Land Rover insurance.