تُعتبر سيارات شيفروليه من السيارات المنتشرة في دولة الإمارات، ويُطلق عليها أيضًا اسم “شيفي” (Chevy). يحبها الكثيرون لما تتميز به من أداء ممتاز وتصميم عصري. امتلاك سيارة شيفروليه في الإمارات يُعد استثمارًا كبيرًا، ومثل أي استثمار آخر، تحتاج سيارتك إلى الحماية. لهذا السبب يُعد تأمين سيارات شيفروليه في الإمارات أمرًا ضروريًا.

إن امتلاك بوليصة تأمين جيدة لسيارة شيفروليه يحمي استثمارك، ولهذا فإن اختيار تأمين شامل سيارة شيفروليه عبر الإنترنت خطوة مهمة. وبغض النظر عن طراز سيارتك من شيفروليه، ستحصل على حماية مالية تضمن لك الدعم الكامل في حال التعرض للسرقة أو الحوادث المرورية أو الكوارث الطبيعية.

تأمين سيارة شيفروليه في الإمارات

تحظى سيارات شيفروليه بشعبية كبيرة في الإمارات بفضل الأداء الأمريكي المتميز والراحة العالية. ولكن قد تكون تكلفة التأمين أعلى في حال لم تكن السيارة بمواصفات الخليج (GCC-spec)، إذ تميل شركات التأمين إلى فرض أقساط أعلى على السيارات المستوردة.

ويرجع ذلك إلى أن السيارات غير الخليجية تحتاج أحيانًا إلى قطع غيار أو إصلاحات غير متوفرة بسهولة محليًا.

مع ذلك، يمكنك إيجاد خيارات ممتازة من شركات تأمين سيارات شيفروليه في الإمارات عند المقارنة بين الخطط المختلفة. تقدم العديد من الشركات تغطيات مخصصة للسيارات الأمريكية، بما في ذلك خدمات مثل المساعدة على الطريق في دبي .

سواء كنت تقود شيفروليه ماليبو، كامارو، أو تاهو، فإن مقارنة عروض تأمين سيارات شيفروليه عبر الإنترنت تساعدك في العثور على خطة مناسبة من حيث الميزانية ومستوى الحماية.

أفضل شركات تأمين سيارات شيفروليه في الإمارات

فيما يلي قائمة بأبرز شركات التأمين في الإمارات التي تقدم خططًا مميزة لتأمين سيارات شيفروليه:

شركة أمان للتأمين

تُعد شركة أمان للتأمين واحدة من أبرز مزودي حلول التأمين المبتكرة في دبي والإمارات بشكل عام. تلتزم بتقديم خطط تأمين شاملة وتجربة عملاء سلسة، مع عملية مطالبة مريحة وسريعة، مما يجعلها خيارًا موثوقًا للأفراد والشركات.

المميزات: خطط شاملة، عملية مطالبة سهلة

شركة نور تكافل – وطنية

تُعتبر شركة نور تكافل (وطنية) من شركات التأمين المتوافقة مع أحكام الشريعة الإسلامية، وتقدم حلول تأمينية شفافة وأخلاقية. تشتهر بحدود تغطية عالية وأسعار تنافسية، مع تركيز قوي على رضا العملاء والأمان المالي.

المميزات: تغطية عالية، تسعير تنافسي

شركة الصقر للتأمين

منذ تأسيسها عام 1979، تُعد شركة الصقر للتأمين من أقدم شركات التأمين وأكثرها موثوقية في الإمارات. تشتهر بخدماتها الموثوقة وشبكة واسعة من الورش المعتمدة لتصليح السيارات، وتوفر حلول تأمين مخصصة لتلبية احتياجات العملاء المختلفة.

المميزات: خدمة موثوقة، شبكة ورش واسعة

شركة أورينتال للتأمين

تُقدم شركة أورينتال للتأمين مجموعة متنوعة من الخيارات الشخصية والتجارية، مع خصومات مرنة لتناسب مختلف الميزانيات. تركز الشركة على تأمين شامل سيارة شيفروليه لتوفير حماية مالية وراحة بال للعملاء.

المميزات: خيارات مخصصة وخصومات، تغطية شاملة

شركة أليانس للتأمين

تُعد شركة أليانس اسمًا موثوقًا في مجال التأمين في الإمارات، حيث تقدم مجموعة واسعة من خيارات التأمين الشخصية والتجارية. تشتهر بالاقتباسات السريعة والدعم الفني على مدار الساعة.

المميزات: عروض سريعة، دعم على مدار الساعة

أنواع خطط تأمين سيارات شيفروليه في الإمارات

سيارات شيفروليه ليست من السيارات المعرضة للمشكلات بشكل خاص، لكنها بطبيعة الحال عرضة للحوادث على الطرق. لذلك، توجد ثلاث فئات رئيسية من خطط تأمين سيارات شيفروليه في الإمارات لتلبية احتياجات جميع السائقين:

1. تأمين شامل سيارة شيفروليه

يُعد هذا التأمين الشامل من التأمين الأكثر شمولًا، حيث يوفر تغطية ضد مجموعة واسعة من الحوادث التي قد تتعرض لها سيارتك.

يضمن هذا النوع من التأمين حماية كاملة لأي طراز من شيفروليه تمتلكه، سواء كانت ماليبو أو سيلفرادو أو ترافيرس.

فهو يغطي الأضرار التي تصيب سيارتك وكذلك الأضرار التي قد تتسبب بها للآخرين.

كما يشمل التعويض عن الحريق، السرقة، الكوارث الطبيعية، والحوادث المرورية.

إذا كنت تبحث عن أقصى درجات الحماية، فإن تأمين شامل سيارة شيفروليه هو الخيار المثالي لك.

2. تأمين المسؤولية تجاه الغير لسيارة شيفروليه

التأمين ضد الغير من التأمين مناسب لمن يبحثون عن تغطية أساسية وبأسعار منخفضة.

يغطي هذا النوع الأضرار التي قد تسببها سيارتك لممتلكات أو أشخاص آخرين، ولكنه لا يغطي الأضرار التي تصيب سيارتك نفسها.

ورغم أن التكلفة منخفضة، إلا أن الحماية محدودة.

من الجدير بالذكر أن هذا النوع من التأمين إلزامي بموجب القانون الإماراتي، لذا لا يمكن القيادة بدونه.

الإضافات في تأمين سيارات شيفروليه

في بعض الأحيان، لا تكون التغطية الأساسية كافية لتلبية احتياجاتك الخاصة، لذا يمكن إضافة بعض المميزات الإضافية للحصول على تجربة تأمين أكثر تخصيصًا، مثل:

المساعدة على الطريق: توفر الدعم في حال تعطل السيارة أو انفجار الإطارات أو أي طارئ أثناء القيادة.

تغطية بدون استهلاك: تضمن حصولك على التعويض الكامل دون خصم قيمة الاستهلاك من السيارة.

حماية خصم عدم المطالبة: تمكنك من الاحتفاظ بخصمك حتى إذا قدمت مطالبة خلال فترة الوثيقة.

تغطية المستهلكات: تشمل تكلفة المواد الاستهلاكية مثل زيت المحرك وسائل الفرامل وغيرها أثناء الإصلاح.

هذه الإضافات تساعد على سد الفجوات بين ما تحتاجه فعلاً وما تغطيه وثيقتك الأساسية من تأمين سيارات شيفروليه، مما يمنحك تجربة حماية شاملة ومريحة على الطريق.

تأمين سيارات شيفروليه لمختلف الموديلات

من المهم معرفة أن تكلفة التأمين وتغطية كل موديل من سيارات شيفروليه تختلف حسب النوع والسنة. في هذا القسم سنستعرض مقارنة بين بعض الموديلات الشهيرة من شيفروليه في الإمارات.

تكلفة تأمين شيفروليه كورفيت

تُعد كورفيت من السيارات الرياضية الفاخرة، ولهذا فإن كم تكلفة تأمين شيفروليه سيارة من هذا النوع عادةً تكون أعلى من غيرها. لكن يمكنك إدارة التكلفة بسهولة من خلال مقارنة الخطط المختلفة عبر منصات التأمين واختيار الخصومات المخصصة لتناسبك.

تأمين شيفروليه كروز 2014

عادةً ما يكون تأمين سيارات شيفروليه الأقدم مثل كروز 2014 أقل تكلفة بسبب انخفاض القيمة السوقية بمرور الوقت. ومع ذلك، تأكد من أن وثيقتك تشمل المكونات الأساسية مثل حماية المحرك والتغطية ضد الحوادث المفاجئة.

تكلفة تأمين شيفروليه سيلفرادو

باعتبارها شاحنة قوية متعددة الاستخدامات، تحتاج سيلفرادو إلى تأمين شامل سيارة شيفروليه لتوفير أقصى حماية نظرًا لقيمتها السوقية المرتفعة واستخدامها المكثف. التأمين الشامل يضمن لك تغطية كاملة أثناء القيادة على الطرق الإماراتية.

تأمين شيفروليه سبارك

السيارات الصغيرة مثل شيفروليه سبارك معروفة بأنها اقتصادية في الوقود والتأمين، إذ إن كم تكلفة تأمين شيفروليه سيارة من هذا النوع عادة ما تكون منخفضة. ولزيادة الحماية، يمكنك إضافة خدمات مثل المساعدة على الطريق ضمن وثيقتك.

ما الذي يشمله ولا يشمله تأمين سيارات شيفروليه؟

عادةً ما تقدم شركات التأمين في الإمارات خيارين رئيسيين لمالكي سيارات شيفروليه:

تأمين ضد الغير وتأمين شامل سيارة شيفروليه. إليك تفاصيل كل نوع:

ما يشمله تأمين سيارات شيفروليه:

تأمين ضد الغير: يغطي الأضرار التي تلحق بالمركبات أو الممتلكات الأخرى في حال كنت المتسبب بالحادث.

تأمين شامل سيارة شيفروليه: يشمل تأمين الطرف الثالث إضافة إلى حماية سيارتك من السرقة أو الحريق أو التخريب أو الكوارث الطبيعية.

إصلاح الوكالة: لبعض الموديلات الحديثة، يُسمح بالإصلاح داخل مراكز خدمة شيفروليه الرسمية.

تغطية الحوادث الشخصية: توفر تعويضات ومصاريف طبية لك وللركاب.

الإضافات: مثل الحماية أثناء القيادة على الطرق الوعرة أو تلف الزجاج الأمامي أو خدمة المساعدة على الطريق في دبي.

ما لا يشمله التأمين:

الأضرار الناتجة عن القيادة المتهورة أو تحت تأثير الكحول.

الأعطال الميكانيكية أو التلف العادي.

استخدام السيارة لأغراض تجارية دون تصريح.

القيادة خارج الإمارات بدون تغطية حدودية مناسبة.

دائمًا اقرأ بنود وثيقة تأمين سيارات شيفروليه بعناية قبل التوقيع، لأن بعض الشركات تختلف في الاستثناءات وشروط المطالبات.

أسعار تأمين سيارات شيفروليه في الإمارات

تختلف كم تكلفة تأمين شيفروليه سيارة حسب الموديل، نوع التغطية، وشركة التأمين.

بشكل عام، تتراوح أسعار تأمين شامل سيارة شيفروليه في الإمارات بين 1,200 و7,000 درهم سنويًا.

وفيما يلي لمحة عن متوسط الأسعار للموديلات الشهيرة:

| الموديل | متوسط السعر السنوي (شامل) |

|---|---|

| شيفروليه سبارك / بولت | 1,200 – 2,000 درهم |

| شيفروليه كابتيفا | 1,600 – 5,200 درهم |

| شيفروليه تاهو | 3,600 – 6,200 درهم |

| شيفروليه كامارو | 5,600 – 7,000 درهم |

التأمين ضد الغير أرخص بكثير، لكنه محدود التغطية. لذلك يُفضل مقارنة خطط تأمين سيارات شيفروليه عبر الإنترنت لاختيار السعر الأدق والخطة الأنسب.

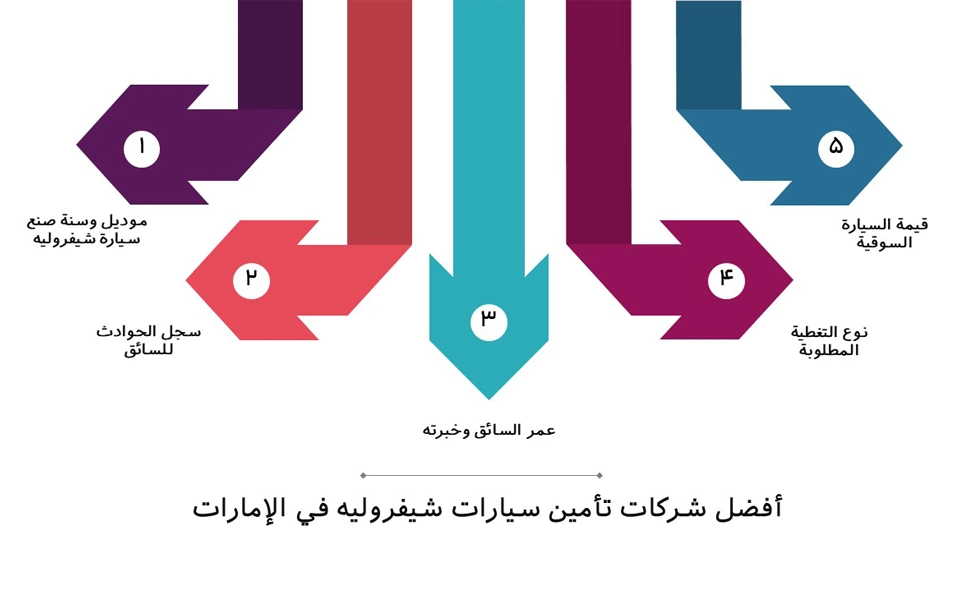

العوامل المؤثرة على تكلفة تأمين سيارات شيفروليه

شركات التأمين في الإمارات تحدد كم تكلفة تأمين شيفروليه سيارة بناءً على عدة عوامل، منها:

الموديل والسنة: السيارات الرياضية مثل كامارو أو كورفيت تكلف أكثر من السيدان الصغيرة.

عمر السائق وخبرته: السائقون الجدد عادةً ما يدفعون أكثر.

سجل المطالبات: خلو السجل من الحوادث يمنحك خصم "عدم المطالبة".

نوع التغطية: التأمين الشامل أغلى، لكنه يوفر حماية كاملة.

نمط الاستخدام: القيادة اليومية لمسافات طويلة قد ترفع التكلفة قليلًا.

أنظمة الأمان: وجود نظام إنذار أو خصائص أمان متقدمة يخفض السعر.

معرفة هذه العوامل تساعدك في حساب كم تكلفة تأمين شيفروليه سيارة بدقة، واتخاذ خطوات لتقليل القسط السنوي.

تأمين سيارات شيفروليه رخيص – كيف توفر أكثر؟

يمكنك الحصول على تأمين شامل سيارة شيفروليه قوي بسعر مناسب من خلال اتباع بعض النصائح الذكية:

قارن بين أكثر من عرض عبر الإنترنت لاكتشاف الخصومات المخفية والعروض الخاصة.

استبعد الإضافات غير الضرورية، مثل التأمين على الطرق الوعرة إذا كنت تقود داخل المدينة فقط.

ادمج وثائق التأمين، فبعض الشركات تقدم خصمًا عند الجمع بين تأمين المنزل والسيارة.

حافظ على سجل قيادة نظيف لتستفيد من خصم عدم المطالبة.

اختر نسبة تحمل أعلى إذا كنت واثقًا من قيادتك، مما يخفض القسط الإجمالي.

بهذه الطريقة، يمكنك الحصول على تأمين سيارات شيفروليه مميز وسعر مناسب دون التنازل عن مستوى الحماية.

كيفية شراء تأمين سيارات شيفروليه عبر لوکینشور

عملية شراء أو تجديد تأمين شامل سيارة شيفروليه عبر الإنترنت أصبحت سهلة وسريعة:

الخطوات:

زيارة الموقع الإلكتروني

انتقل إلى موقع لوکینشور وسجّل حسابك، ثم أدخل بيانات السيارة المطلوبة.

الحصول على عروض الأسعار

استخدم أداة المقارنة لعرض خطط تأمين سيارات شيفروليه المختلفة، وقارن بين الأسعار والتغطيات.

إكمال الطلب والدفع

بعد اختيار الخطة المناسبة، املأ النموذج وادفع إلكترونيًا بأمان. يمكنك الدفع كاملًا أو بالتقسيط على 4 دفعات.

ستتلقى وثيقتك فورًا عبر البريد الإلكتروني.

المستندات المطلوبة:

بطاقة الهوية الإماراتية

رخصة القيادة

ملكية المركبة (الملكية)

وثيقة التأمين السابقة (في حالة التجديد)

تجديد تأمين سيارات شيفروليه عبر الإنترنت

تجديد تأمين شامل سيارة شيفروليه أصبح في غاية السهولة في الإمارات. يمكنك إنجاز العملية خلال دقائق عبر المنصات الإلكترونية.

الخطوات:

زيارة موقع الشركة أو منصة لوکینشور

إدخال رقم الوثيقة وبيانات السيارة.

مراجعة التغطية الحالية وتعديل الإضافات حسب الحاجة.

اختيار الخطة والدفع إلكترونيًا.

استلام الوثيقة الجديدة فورًا عبر البريد الإلكتروني.

يساعدك ذلك على استمرار حماية سيارتك دون أي انقطاع في التغطية.

كيفية تقديم مطالبة تأمين سيارات شيفروليه

- تقديم مطالبة تأمين شامل سيارة شيفروليه عبر لوکینشور بسيط للغاية:

- ادخل إلى الموقع، واملأ نموذج المطالبة مع تفاصيل الحادث والمستندات المطلوبة.

- سيتم التعامل مع المطالبة من خلال الشركة، وبمجرد الموافقة تحصل على التعويض المستحق بسرعة.

تأمين سيارات شيفروليه ضروري لكل مالك في الإمارات لحماية سيارته من الأضرار والمخاطر. من خلال مقارنة الأسعار والتغطيات عبر لوکینشور، يمكنك اختيار تأمين شامل سيارة شيفروليه يناسب احتياجاتك ويمنحك راحة البال على الطريق.

الأسئلة الشائعة

عن طريق وكيل التأمين: بالتواصل مع وكيل التأمين الخاص بك.

عن طريق مراكز الخدمة: بعض شركات التأمين لديها مراكز خدمة يمكنك زيارتها لتجديد التأمين.