امتلاك سيارة فيات في الإمارات يأتي مع مجموعة من المسؤوليات، ومن أهمها الحصول على الحماية التأمينية المناسبة. سواء كنت تقود موديل مدمج وصغير يناسب شوارع المدينة أو كروس أوفر أنيق، فإن تأمين سيارة فيات في الإمارات يساعدك على حماية مركبتك وضمان التزامك بالقوانين المحلية. ومن خلال فهم خياراتك، يمكنك العثور على خطة تأمين تناسب ميزانيتك وتمنحك راحة البال أثناء القيادة.

تأمين سيارة فيات في الإمارات

تُعرف سيارات فيات بكفاءتها العالية وتصاميمها العصرية وملاءمتها للقيادة داخل المدن. وبسبب هذه المميزات، يفضّل العديد من مالكي فيات الحصول على وثائق تأمين تجمع بين الأسعار المناسبة والتغطية الكافية. في الإمارات، يشمل تأمين سيارة فيات عادةً الحماية من الحوادث، والمسؤولية تجاه الغير، والسرقة، والكوارث الطبيعية. كما قد توفر بعض شركات التأمين مزايا إضافية مثل المساعدة على الطريق أو استبدال السيارة في حالة الخسارة الكلية.

عند اختيار تأمين سيارة فيات في الإمارات، من المهم أن تراعي طبيعة استخدامك لسيارتك. على سبيل المثال، إذا كنت تقود مسافات قصيرة داخل المدينة، فقد يكون تأمين الطرف الثالث كافيًا. أما إذا كنت تملك سيارة فيات جديدة، فيُنصح غالبًا بالحصول على التأمين الشامل لأنه يمنحك حماية أوسع ضد الحوادث أو الأحداث غير المتوقعة.

أنواع تأمين سيارات فيات في الإمارات

في لوکینشور، نؤمن أن كل مالك فيات يستحق خطة تأمين مصممة خصيصًا لتلبية احتياجاته. لذلك نوفر حلول تأمينية مرنة تساعدك على الحصول على أفضل خيار يناسبك سواء كنت تؤمّن سيارة فيات 500 الأنيقة أو فيات باندا العملية. تنوع خططنا يجعل من السهل العثور على الوثيقة المناسبة لك.

التأمين الشامل على سيارات فيات

خطط تأمين سيارة فيات في الإمارات لدينا تقدم حماية موسعة تتجاوز التغطية الأساسية. ومع خيارات متعددة، يمكنك اختيار الخطة التي تتماشى مع عادات قيادتك وميزانيتك. أبرز مزايا التأمين الشامل:

تغطية كاملة ضد الحوادث: حماية سيارتك من الأضرار الناتجة عن الحوادث مهما كان المتسبب.

الحماية من السرقة والتخريب: تعويضك في حال تعرض سيارتك للسرقة أو التخريب.

الكوارث الطبيعية والحريق: تغطية الأضرار الناتجة عن الحرائق أو الفيضانات أو العواصف.

تأمين ضد الإصابات الشخصية: يشمل نفقات العلاج لك وللركاب عند وقوع حادث.

المساعدة على الطريق: دعم 24/7 في حالات الأعطال أو انفجار الإطارات أو الطوارئ الأخرى.

حماية الإكسسوارات: يشمل أي إضافات أو تجهيزات خاصة بسيارتك، مما يضمن أنك محمي بالكامل.

هذه الخطط تمنحك مرونة كبيرة لتخصيص التغطية الشاملة، مما يضمن راحة البال أثناء القيادة.

تأمين الطرف الثالث لسيارات فيات

إذا كنت تبحث عن خيار اقتصادي، فإن تأمين الطرف الثالث يعد من أرخص تأمين سيارات فيات الإمارات، حيث يغطي الأضرار التي قد تسببها للآخرين أو ممتلكاتهم. هذا النوع من التأمين مثالي للسائقين الراغبين في تلبية المتطلبات القانونية بأقل تكلفة، لكنه لا يغطي أضرار سيارتك الخاصة.

تأمين فجوة القيمة (Gap Insurance)

تأمين فجوة القيمة لسيارات فيات يعد خيارًا ذكيًا لمن يرغب في حماية استثماره المالي. فهو يغطي الفرق بين قيمة القرض المستحق على السيارة وقيمتها السوقية الفعلية في حال حدوث خسارة كلية. هذه التغطية مفيدة بشكل خاص لملاك السيارات الجديدة التي تنخفض قيمتها بسرعة.

الإضافات الخاصة بسيارات فيات

لتعزيز الحماية أكثر، تقدم لوکینشور مجموعة من الإضافات المصممة خصيصًا لسيارات فيات. يمكنك تخصيص وثيقتك لتشمل مميزات مثل التعويض عن سيارة بديلة أو تغطية النفقات القانونية. ومن هذه الإضافات:

| نوع الإضافة | اسم الإضافة | الوصف |

|---|---|---|

| إكسسوارات داخلية | فرش أرضيات | فرش مخصص لحماية أرضية السيارة. |

| أغطية مقاعد | تحمي المقاعد من التلف بمواد مختلفة. | |

| واقيات شمس | تحافظ على برودة السيارة بحجب أشعة الشمس. | |

| إكسسوارات خارجية | حوامل سقف | لحمل أغراض إضافية مثل الدراجات. |

| أطقم هيكل | تعطي مظهرًا رياضيًا للسيارة. | |

| أجنحة خلفية | لتحسين الديناميكية الهوائية. | |

| تقنيات | ترقية أنظمة الترفيه | أنظمة صوت وملاحة متطورة. |

| اتصال بلوتوث | مكالمات لاسلكية وتشغيل موسيقى. | |

| كاميرا خلفية | تساعد في الركن والرجوع للخلف بأمان. | |

| ترقيات الأداء | نظام عادم مخصص | يحسن الأداء ويعطي صوتًا رياضيًا. |

| مداخل هواء بارد | تزيد كفاءة المحرك وقوته. | |

| أنظمة تعليق | لثبات أفضل ولمسة رياضية. | |

| أنظمة أمان | مراقبة النقاط العمياء | تنبيه السائق بوجود سيارات بجانبه. |

| حساسات ركن | تساعد على اكتشاف العوائق عند الوقوف. | |

| كاميرا أمامية/خلفية (Dash Cam) | تسجيل القيادة لتعزيز الأمان. |

ما يشمله وما لا يشمله تأمين سيارة فيات في الإمارات

عند شراء تأمين سيارة فيات في الإمارات، من المهم أن تعرف ما الذي تتضمنه وثيقتك بالفعل. تفاصيل التغطية قد تختلف حسب نوع الخطة التي تختارها، وفيما يلي نظرة عامة على ما يمكن أن يشمله التأمين عادةً وما لا يشمله:

ما يشمله التأمين:

الأضرار التي تلحق بسيارتك فيات نتيجة الحوادث.

المسؤولية تجاه الغير عن الإصابات أو الأضرار في الممتلكات.

الحريق، السرقة أو الكوارث الطبيعية (بحسب نوع الخطة).

النفقات الطبية بعد وقوع حادث.

تغطية الركاب (في حال كانت مدرجة ضمن الوثيقة).

ما لا يشمله التأمين:

التلف أو التآكل الطبيعي للسيارة.

الأعطال الميكانيكية أو الكهربائية.

القيادة بدون رخصة سارية أو تحت تأثير المواد المخدرة.

الأضرار التي تقع خارج منطقة التغطية الجغرافية للوثيقة.

استخدام السيارة لأغراض غير قانونية أو تجارية غير مذكورة في الوثيقة.

أسعار تامين سيارة فيات الامارات

فهم تكلفة التأمين على أشهر موديلات فيات داخل الإمارات يساعدك على اختيار التغطية المناسبة لاحتياجاتك. تختلف أسعار تامين سيارة فيات الامارات بحسب نوع التغطية (شامل أو طرف ثالث)، موديل السيارة، سنة الصنع، وسجل السائق التأميني. وبفضل لوکینشور، يمكنك بسهولة مقارنة العروض واختيار الأفضل بين العديد من شركات التأمين، مما يتيح لك الوصول إلى أرخص تأمين سيارات فيات الإمارات دون التنازل عن مستوى الحماية.

يوضح الجدول التالي متوسط تكاليف التأمين السنوي لبعض أشهر موديلات فيات في الإمارات، مما يساعدك على مقارنة الخيارات واختيار أرخص تأمين سيارات فيات الإمارات مع التغطية المناسبة:

| موديل فيات | متوسط تكلفة التأمين السنوي | أبرز المميزات |

|---|---|---|

| فيات 500 | 2,800 – 4,200 درهم | تصميم أنيق، موفرة للوقود، شديدة الشعبية |

| فيات باندا | 2,500 – 3,800 درهم | مدمجة وعملية، مثالية للقيادة داخل المدن |

| فيات بونتو | 2,700 – 4,000 درهم | مظهر رياضي، مقصورة واسعة، مناسبة للعائلات |

| فيات 500 أبارث | 3,500 – 5,500 درهم | عالية الأداء، مزودة بشاحن توربيني، خصائص رياضية |

| فيات تيبو | 2,900 – 4,100 درهم | عائلية، شنطة واسعة، مزودة بأنظمة أمان متقدمة |

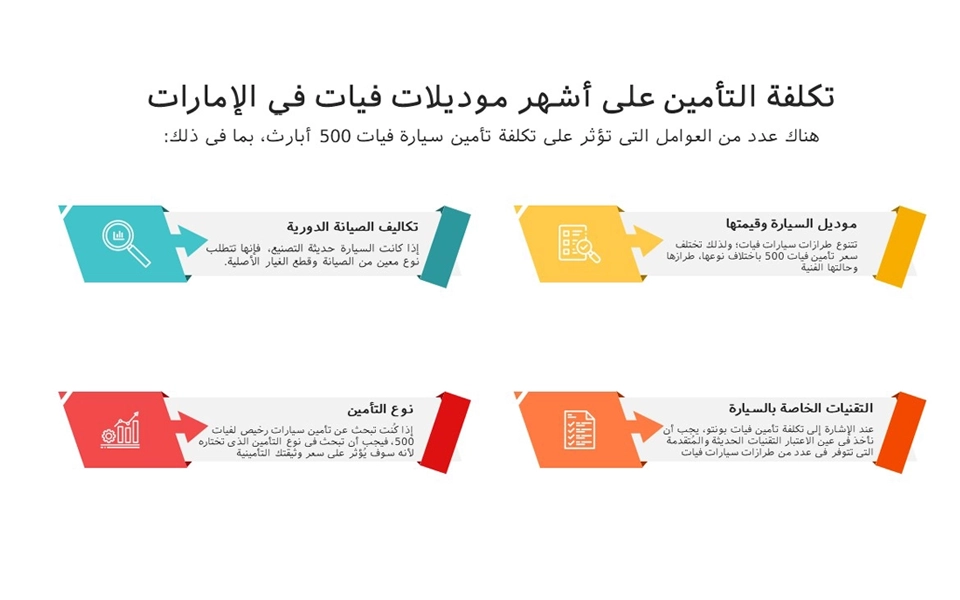

العوامل المؤثرة على أسعار تامين سيارة فيات الامارات

هناك مجموعة من العوامل التي تؤثر على تكلفة تأمين سيارة فيات في الإمارات، ومنها:

سنة الصنع: الموديلات الأحدث تكون تكاليف تأمينها أعلى نظرًا لقيمتها المرتفعة وتقنياتها المتطورة.

سجل القيادة: السائق ذو السجل النظيف يحصل عادة على أقساط أقل، بينما قد تؤدي المطالبات السابقة إلى زيادة التكلفة.

نوع التغطية: التأمين الشامل أغلى من الطرف الثالث، لكنه يوفر حماية أوسع وأكثر شمولًا.

الموقع الجغرافي: القيادة في المناطق الحضرية قد تزيد من تكلفة التأمين بسبب ارتفاع معدلات الحوادث ومخاطر السرقة مقارنة بالمناطق الريفية.

في لوکینشور، نساعدك على فهم هذه العوامل للعثور على أنسب العروض وأفضل الأسعار المصممة خصيصًا لسيارتك، سواء كنت تشتري وثيقة جديدة أو تقوم بـ تجديد تأمين سيارة فيات في الإمارات. لا تتردد في التواصل معنا للحصول على معلومات أكثر تفصيلًا ومساعدة شخصية تناسب احتياجاتك.

أرخص تأمين سيارات فيات الإمارات – كيف توفر أكثر؟

الحصول على أرخص تأمين سيارات فيات الإمارات ممكن إذا عرفت كيف تدير اختياراتك بذكاء. إليك بعض الطرق الفعالة لتخفيض أقساط التأمين دون التنازل عن التغطية الأساسية:

مكافأة عدم المطالبة: إذا كان لديك سجل قيادة نظيف وخالٍ من الحوادث، يمكنك الاستفادة من خصومات عند تجديد تأمين سيارة فيات في الإمارات.

مقارنة البوالص عبر الإنترنت: منصات مثل لوکینشور تتيح لك بسهولة مقارنة الأسعار من عدة شركات واختيار الخيار الأكثر توفيرًا.

زيادة قيمة التحمل : اختيار مبلغ تحمل أعلى يقلل من قيمة القسط، وهو خيار مناسب إذا كنت واثقًا من أن عادات قيادتك آمنة ولن تؤدي إلى مطالبات متكررة.

وثائق تأمين الطرف الثالث (TPL): إذا كنت تقود لمسافات قصيرة أو داخل المدن فقط، فقد يكون هذا النوع من التأمين خيارًا اقتصاديًا مقارنةً بالتأمين الشامل.

كيفية شراء تأمين سيارة فيات في الإمارات عبر لوکینشور

تجعل لوکینشور عملية شراء وثيقة التأمين أو القيام بـ تجديد تأمين سيارة فيات في الإمارات سهلة ومباشرة. فيما يلي الخطوات الأساسية للحصول على أو تجديد خطط التأمين الخاصة بك:

الخطوة 1: الحصول على عرض سعر

يمكنك البدء بالحصول على عرض سعر مخصص لتأمين فيات 500 أو أي موديل آخر من سيارات فيات التي تملكها. كل ما عليك فعله هو زيارة موقعنا وتعبئة نموذج طلب السعر الإلكتروني، مع إدخال بيانات سيارتك، سجل القيادة، وتفضيلات التغطية.

الخطوة 2: مقارنة خيارات التغطية

بعد استلام عرض السعر، خذ وقتك لمراجعة ومقارنة خطط تأمين السيارات في الإمارات. نحن نوفر مجموعة متنوعة من خيارات تأمين سيارة فيات في الإمارات، بما في ذلك التأمين الشامل وتأمين الطرف الثالث.

الخطوة 3: تخصيص وثيقتك

بعد اختيار الخطة المناسبة، يمكنك تخصيص وثيقتك بإضافة تغطيات إضافية مثل تأمين فجوة القيمة أو المساعدة على الطريق.

الخطوة 4: المراجعة والتأكيد

قبل إتمام عملية الشراء، تأكد من مراجعة جميع تفاصيل الوثيقة التي اخترتها، بما في ذلك مستويات التغطية، الأقساط، والإضافات. بمجرد التأكد من رضاك، يمكنك تأكيد الوثيقة والدفع بشكل آمن عبر منصتنا الإلكترونية.

الخطوة 5: استلام وثائق التأمين

بعد إتمام الشراء، ستتلقى وثائق تأمينك عبر البريد الإلكتروني، والتي تتضمن جميع التفاصيل الخاصة بتغطية تأمين سيارة فيات في الإمارات.

تجديد تأمين سيارة فيات في الإمارات

يُعد تجديد تأمين سيارة فيات في الإمارات في الوقت المناسب أمرًا ضروريًا لتجنب الغرامات وضمان استمرار الحماية على طرق الدولة. من خلال خدمات لوکینشور الإلكترونية، يمكن للعملاء إتمام عملية التجديد بسرعة وسهولة.

خطوات تجديد تأمين سيارة فيات عبر لوکینشور:

تسجيل الدخول إلى حسابك في لوکینشور أو إنشاء حساب جديد.

إدخال بيانات الوثيقة الحالية.

إجراء التعديلات اللازمة (إن وجدت).

إتمام الدفع بشكل آمن عبر الإنترنت.

أفضل شركات تأمين سيارة فيات في الإمارات

تقدم العديد من شركات التأمين في الإمارات حلولًا متخصصة لتلبية احتياجات مالكي سيارات فيات. فيما يلي قائمة بأبرز المزودين، بما في ذلك شركاء لوکینشور المعروفين بخدمتهم الممتازة وأسعارهم التنافسية:

| الشركة | المميزات الرئيسية | نوع التغطية |

|---|---|---|

| أكسا للتأمين | من أكبر شركات التأمين العالمية، لها وجود قوي في الإمارات، وتوفر خطط شاملة بأسعار مرنة لسيارة فيات 500 | تأمين شامل وتأمين ضد الغير |

| شركة أبوظبي الوطنية للتأمين (ADNIC) | تقدم مجموعة واسعة من خطط تأمين السيارات في الإمارات مع رضا عملاء مرتفع وسرعة في معالجة المطالبات | تأمين شامل / طرف ثالث |

| شركة قطر للتأمين | خبرة إقليمية واسعة مع خيارات مخصصة لتأمين سيارة فيات في الإمارات بمستويات مختلفة من التغطية | شامل + ضد الغير |

| شركة الاتحاد للتأمين | شركة إماراتية موثوقة تقدم أسعار منافسة وخطط مناسبة لمالكي سيارات فيات | شامل / اقتصادي |

| شركة نور تكافل للتأمين | متخصصة في التأمين المتوافق مع الشريعة الإسلامية، وتوفر خطط مخصصة لتأمين سيارات فيات، مناسبة لمن يبحث عن بدائل أخلاقية | تكافلي / شامل / ضد الغير |

كيفية تقديم مطالبة تأمين سيارة فيات في الإمارات

تقديم مطالبة على وثيقة تأمين سيارة فيات في الإمارات يضمن لك الحصول على الدعم اللازم عند حدوث أي طارئ. إليك الخطوات الأساسية:

الخطوة 1: ضمان السلامة أولًا

في حال تعرضت سيارتك فيات لحادث، تأكد أولًا من سلامة الجميع، واتصل بخدمات الطوارئ عند الحاجة، ثم انقل السيارة لمكان آمن بعيدًا عن حركة المرور.

الخطوة 2: جمع الأدلة

الصور: التقط صورًا واضحة للأضرار، لمركبتك ومركبة الطرف الآخر ومكان الحادث.

التفاصيل: سجّل وقت وتاريخ ومكان الحادث والظروف المحيطة.

الشهود: اجمع بيانات الاتصال في حال وجود شهود.

الخطوة 3: التواصل مع لوکینشور

أبلغ لوکینشور بالحادث في أسرع وقت لبدء عملية المطالبة، سواء عبر:

الهاتف: الاتصال بخط الطوارئ المخصص.

البريد الإلكتروني: إرسال تفاصيل الحادث والمستندات المطلوبة.

الخطوة 4: تعبئة نموذج المطالبة

بعد الإبلاغ، سيرشدك فريقنا لاستكمال نموذج المطالبة الذي يتطلب:

رقم الوثيقة

تفاصيل الحادث

تقدير تكاليف الإصلاح (إن وجدت)

الخطوة 5: تقديم المستندات المطلوبة

أرسل مع النموذج المستندات التالية:

نسخة من وثيقة التأمين الخاصة بك.

نسخة من تقرير الشرطة (إن وجد).

فواتير أو إيصالات المصاريف ذات الصلة.

الخطوة 6: تقييم المطالبة

يقوم فريق المطالبات بمراجعة الحادث، بما في ذلك فحص السيارة، مراجعة التقارير الرسمية، وتقدير تكاليف الإصلاح.

الخطوة 7: قرار المطالبة

بمجرد اكتمال التقييم، يتم إعلامك بقرار المطالبة.

الخطوة 8: إصلاح السيارة والتعويض

في حال الموافقة، يمكنك أخذ سيارتك فيات لمركز إصلاح معتمد، أو استرداد التكاليف حسب نوع الوثيقة.

المستندات المطلوبة للحصول على تأمين سيارة فيات في الإمارات

مع لوکینشور، الحصول على أرخص تأمين سيارات فيات الإمارات يتم بسهولة وبأقل تعقيد. المستندات المطلوبة تشمل:

رقم تسجيل السيارة (اللوحة): لتحديد سيارتك فيات بدقة.

بطاقة الهوية الإماراتية أو ID Pass: للتحقق من هويتك.

بطاقة ائتمان/خصم: لدفع أقساط التأمين بسهولة، مع إمكانية السداد بالتقسيط عبر خدمات مثل Tabby أو Tamara.

شهادة عدم المطالبة (NCD) – إن وجدت: للاستفادة من خصومات تصل إلى 60% للسائقين الذين لم يتقدموا بمطالبات لمدة تزيد عن 6 سنوات.

تأمين سيارة فيات في الإمارات أصبح أكثر سهولة مع لوکینشور. نحن نوفر وثائق مخصصة، أسعار تنافسية في وثائق وأسعار تامين سيارة فيات الامارات، وإجراءات مطالبة بسيطة لتلبية احتياجاتك. سواء كنت تبحث عن شراء وثيقة جديدة أو القيام بـ تجديد تأمين سيارة فيات في الإمارات، فإننا ملتزمون بتقديم أفضل الحلول التأمينية لسيارتك.