يُعد تأمين سيارات رولز رويس من أكثر أنواع التأمين الفاخرة المطلوبة في الإمارات، حيث يُعتبر ضروريًا لكل من يمتلك سيارة من هذا الطراز الفخم. اختيار رولز رويس سيارة تأمين شامل مناسب يساعدك على تقليل المخاطر وحماية استثمارك الكبير والحفاظ على سيارتك باهظة الثمن في أفضل حالاتها. للحصول على أفضل تغطية، من المهم مقارنة الأسعار بين مختلف شركات التأمين عبر منصة لوكينشور لمعرفة أفضل تكلفة تأمين سيارة رولز رويس، ومعرفة تفاصيل كل بوليصة تأمين، لتختار الخطة الأنسب لاحتياجاتك وتوقعاتك.

تأمين سيارات رولز رويس في الإمارات

الحصول على تأمين سيارات رولز رويس مخصص هو خطوة أساسية في امتلاك هذا النوع من المركبات الفاخرة داخل الإمارات، حيث يتجاوز مجرد الالتزام القانوني. فالسيارات من هذا النوع تحتاج إلى تأمين مصمم بعناية يعكس قيمتها العالية وندرة قطع غيارها، إضافةً إلى مهارة الصيانة المطلوبة في حال وقوع ضرر.

نظرًا لقيمة السيارة الكبيرة، فإن اختيار رولز رويس سيارة تأمين شامل يضمن لك إصلاحات في الوكالة باستخدام قطع أصلية، إضافة إلى تغطية شاملة محلية وعالمية. فهم تفاصيل بوليصة التأمين الخاصة بهذا النوع من السيارات هو أساس حماية استثمارك في بيئة قيادة مليئة بالتحديات.

أنواع تأمين سيارات رولز رويس في الإمارات

هناك العديد من أنواع تأمين سيارات رولز رويس التي يمكنك الاختيار من بينها لتأمين مركبتك الفاخرة، وجميعها مصممة خصيصًا لهذا النوع من السيارات.

1. رولز رويس سيارة تأمين شامل

يُعتبر التأمين الشامل أو ما يُعرف باسم رولز رويس سيارة تأمين شامل هو الخيار الأفضل لمالكي السيارات الفاخرة، حيث يغطي الأضرار الناتجة عن الحوادث، والحرائق، والكوارث الطبيعية، والسرقة، وحوادث الطريق، إضافةً إلى المسؤوليات تجاه الغير.

كما يشمل إصلاح السيارة في مراكز معتمدة مدرَّبة خصيصًا للتعامل مع سيارات رولز رويس باستخدام قطع أصلية 100%.

2. التأمين ضد الغير

يُعد التأمين ضد الغير الحد الأدنى الإلزامي من التأمين في الإمارات. يوفّر حماية ضد الأضرار أو الإصابات التي قد تلحق بالآخرين أو ممتلكاتهم. وتقدم منصة لوكينشور خطط تأمين ضد الغير مخصصة لسيارات رولز رويس، ويمكن تعزيزها بإضافات اختيارية لزيادة الحماية.

3. تأمين خاص بسيارات رولز رويس الكلاسيكية

بعض مالكي السيارات القديمة يحتاجون إلى نوع خاص من التأمين، وتوفّر منصة لوكينشور خططًا مخصصة لسيارات رولز رويس الكلاسيكية تشمل تغطية القيمة المتفق عليها، وتغطية النقل والتخزين، والتأمين أثناء الصيانة أو الترميم.

إضافات تأمين سيارات رولز رويس

يمكنك إضافة مميزات اختيارية على بوليصتك لتخصيص الحماية بما يتناسب مع احتياجاتك. ومن أشهر الإضافات التي يمكن ضمّها إلى رولز رويس سيارة تأمين شامل:

حماية المحرك وناقل الحركة

تغطية الفقد الكلي أو الكسر

حماية الزجاج والمفاتيح

تأمين الحوادث الشخصية للركاب

استبدال السيارة عند الفقد الكلي

تغطية عالمية أثناء السفر

ما الذي يشمله أو لا يشمله تأمين سيارات رولز رويس؟

يشمل التأمين عادةً:

الأضرار الناتجة عن الحوادث: إصلاح أو استبدال السيارة في مراكز رولز رويس المعتمدة.

السرقة أو الفقد الكلي: تعويض بالقيمة الفعلية المتفق عليها للسيارة.

المسؤولية تجاه الغير: تغطية إصابات الأشخاص أو الأضرار التي تلحق بممتلكاتهم.

الإصلاح في الوكالة: ميزة ضرورية للحفاظ على جودة السيارة وقيمتها.

التغطية العالمية: متاحة كخيار إضافي لحماية سيارتك أثناء السفر لدول الخليج.

لا يشمل التأمين عادةً:

التلف الناتج عن الاستهلاك الطبيعي مثل الإطارات والمكابح.

الأضرار الناتجة عن الإهمال أو الصيانة غير الدورية.

التعديلات غير الرسمية على السيارة.

الاستخدام خارج الطرق المعبدة إلا إذا تمت إضافته ضمن الخطة.

تكلفة تأمين سيارة رولز رويس في الإمارات

تحديد تكلفة تأمين سيارة رولز رويس يعتمد على قيمة السيارة وخيارات التغطية، وعادة ما تتراوح بين 1.2% إلى 3.5% من قيمة السيارة المتفق عليها.

رولز رويس جوست: تبدأ قيمة السيارة من 1,800,000 درهم، وتكون تكلفة التأمين الشامل تقريبًا بين 21,600 و63,000 درهم سنويًا.

رولز رويس فانتوم: قيمة السيارة غالبًا تتجاوز 2,500,000 درهم، وتكون تكلفة التأمين الشامل بين 30,000 و87,500 درهم سنويًا.

رولز رويس كولينان: السيارة SUV الفاخرة، تكلفة التأمين الشامل تتراوح بين 30,000 و50,000 درهم، بينما التأمين ضد الغير حوالي 10,000 إلى 15,000 درهم سنويًا.

عوامل تؤثر على تكلفة التأمين:

القيمة المتفق عليها للسيارة.

نوع وطراز السيارة (فانتوم أعلى من جوست).

عمر وخبرة السائق وسجل المطالبات السابقة.

مكان وقوف السيارة وأمانها.

نطاق التغطية والملحقات الاختيارية مثل التغطية العالمية وعدم الاهتلاك.

طرق لتقليل تكلفة التأمين:

زيادة قيمة التحمل (Deductible) لتقليل القسط السنوي.

مقارنة عروض متعددة للحصول على أفضل سعر.

اختيار بوليصة مخصصة لتغطية الاحتياجات المهمة فقط.

تقليل عدد المطالبات للحفاظ على خصم عدم المطالبة.

أفضل شركات تأمين سيارات رولز رويس في الإمارات

من خلال منصة لوكينشور يمكنك الوصول لأفضل مزودي التأمين للسيارات الفاخرة وبتكلفة تأمين سيارة رولز رويس ميسورة، مثل:

| شركة التأمين | أبرز المميزات |

|---|---|

| شركة التأمين الصقر | تغطية شاملة، خدمات متميزة، حلول مؤسسية |

| شركة الخليج للتأمين (GIG) | سياسات مخصصة، تغطية عالمية، سمعة ممتازة |

| شركة الفجيرة الوطنية للتأمين (AFNIC) | بوليصات شاملة، أسعار تنافسية، خبرة طويلة |

| شركة سلامة للتأمين | حلول مخصصة، دعم عملاء قوي، تغطية شاملة |

| شركة التأمين الشرقية | منتجات فردية ومؤسسية، دعم المطالبات، موثوقية مالية |

| شركة رأس الخيمة للتأمين (RAK) | خيارات شاملة، خدمات مريحة، خطط قابلة للتخصيص |

| شركة سكون للتأمين | منتجات واسعة، خطط مخصصة، دعم العملاء سريع وموثوق |

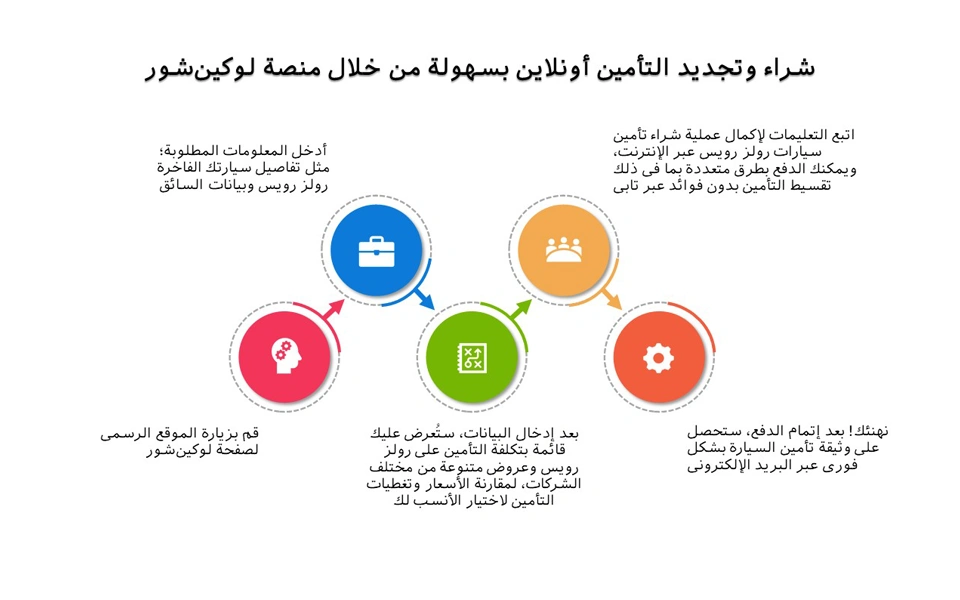

كيفية شراء وتجديد رولز رويس سيارة تأمين شامل أونلاين

لشراء التأمين والحفاظ تكلفة تأمين سيارة رولز رويس ميسورة:

زيارة موقع لوكينشور.

الحصول على عرض فوري.

ملء البيانات المطلوبة وإنشاء ملف شخصي.

مقارنة العروض واختيار الأنسب.

اختيار الملحقات الاختيارية والدفع.

استلام تأكيد البوليصة.

لتجديد التأمين:

تسجيل الدخول لحسابك على لوكينشور.

مراجعة السياسات السابقة والحالية.

اختيار البوليصة المراد تجديدها.

تعديل الخيارات والملحقات إذا لزم الأمر.

الدفع واستلام التأكيد.

المستندات المطلوبة لتسهيل عملية التأمين

بطاقة الهوية الإماراتية.

التأشيرة وجواز السفر للمقيمين.

رخصة القيادة الإماراتية سارية المفعول.

بطاقة تسجيل السيارة (ملكية).

كشف حساب بنكي.

كيفية تقديم مطالبة تأمين رولز رويس

الاتصال بالشرطة فور وقوع الحادث.

إبلاغ شركة التأمين.

تعبئة نموذج المطالبة على موقع لوكينشور.

إرفاق المستندات الضرورية مثل تقرير الشرطة.

مراجعة جميع المعلومات.

تقديم النموذج.

متابعة حالة المطالبة عبر حسابك على لوكينشور.

تأمين سيارات رولز رويس في الإمارات شائع جدًا، واختيار البوليصة المناسبة يضمن حماية استثمارك في هذه السيارات الفاخرة. منصة لوكينشور توفر حلول تأمين متكاملة لكل الاحتياجات مع مراعاة تكلفة تأمين سيارة رولز رويس والعوامل الخاصة بالسائق والطراز وقيمة السيارة. تأمين سيارة رولز رويس في الإمارات وشوارع دبي الساحرة لم يعد رفاهية، بل ضرورة للحفاظ على مركبتك الفاخرة، وبعد أن عرفت كيفية شراء وتجديد تأمين رولز رويس عبر الإنترنت، وتكلفة التأمين على رولز رويس أصبح الحصول على تأمين السيارات الفاخرة طراز كولينان وغيرها أمرًا يسيرًا، ماذا تنتظر؛ الفخامة تتطلب الحماية، قارن واشترِ التأمين المثالي!