Porsche Car Insurance in the UAE: Premium Coverage at the Best Rates

Flexible installments to pay later with

And

Regulated by the Government of Dubai

When we watch luxury Porsche car videos on Instagram in Dubai, we can’t help but wonder about the maintenance and Porsche car insurance that make owning such high-end vehicles in the UAE easier. With the growing number of these prestigious vehicles on the roads, it’s clear that Porsche insurance is more than just a mandatory choice in the UAE; it’s a passion for keeping your valuable car valued.

At Lookinsure, we recognize that as an owner of a luxury car like a Porsche, you want unique insurance needs. We offer a variety of coverage options tailored specifically for all Porsche models. Whether you need special coverage for Porsche Taycan insurance, car insurance for Porsche Cayenne, or tips to find the best insurance for Porsche in the UAE, we’ve got your back. Explore competitive rates and receive the best Porsche insurance quote tailored to your vehicle’s needs because protecting your investment in car insurance online Dubai should be as seamless and luxurious as driving it.

Tailored Insurance Solutions for Porsche Car Insurance

Our approach ensures that whether you own a classic Porsche or the newest model in the lineup, you can access Porsche car insurance comprehensive coverage options that fit your lifestyle and driving habits. To give you an overview of our comprehensive coverage plans suitable for Porsche owners, here’s a table outlining the features of each plan:

Coverage Plan | Comprehensive Coverage | Third-Party Coverage | Gap Insurance | Add-Ons Available |

Basic Protection | ✔️ Yes | ✔️ Yes | ✖️ No | Roadside Assistance |

Liability Coverage | ✔️ Yes | ✔️ Yes | ✖️ No | Rental Car Reimbursement |

Theft and Vandalism | ✔️ Yes | ✖️ No | ✖️ No | Custom Parts Coverage |

Accidental Damage | ✔️ Yes | ✖️ No | ✖️ No | Electronic Equipment Coverage |

Medical Expenses | ✔️ Yes | ✖️ No | ✖️ No | Additional Liability Coverage |

Depreciation Coverage | ✔️ Yes | ✖️ No | ✔️ Yes | Classic Car Coverage |

Comprehensive Porsche Car Insurance

Comprehensive Porsche car insurance provides extensive coverage against theft, vandalism, and accidents. This policy covers damages to your Porsche and includes provisions for personal liability, medical expenses, and even loss of personal items inside the car.

Third-Party Porsche Auto Insurance

For those looking for budget-friendly options or the cheapest Porsche car insurance, we recommend third-party insurance. This option covers only the damages you cause to other vehicles or property. While this option doesn’t cover your own Porsche in the event of an accident, it meets the legal requirements for driving in the UAE and offers financial protection against claims from other road users. It’s a practical choice for those who want to balance Porsche insurance cost and coverage.

Porsche Gap Insurance

If your Porsche is ever totaled or stolen, it can be tough to recover your full investment. That’s where Porsche gap insurance comes in. This specialized Porsche car insurance coverage bridges the gap between what you owe on your vehicle and its actual cash value, ensuring you don’t face a financial shortfall in a tough situation. This is especially valuable for new or high-end models, where depreciation can hit hard.

Add-ons for Porsche Cars

Porsche motor insurance with various add-ons tailored to your needs will become a full package. From roadside assistance and rental car coverage to coverage for electronic equipment and custom parts, our add-ons allow you to create a Porsche insurance policy that fits every situation you can face with.

Cost of Insurance for Popular Porsche Models in the UAE

Typically, Porsche insurance rates are influenced by the vehicle's value and repair costs. For instance, the cost of car insurance Porsche 911, the iconic model, is much higher than others due to its sports car status and performance capabilities.

Here’s a table showcasing potential annual premiums from different insurance companies for selected Porsche models:

Porsche Model | Emirates Insurance Company | Abu Dhabi Insurance Company | Orient Insurance | Average Annual Cost |

Porsche 911 | AED 6,500 | AED 7,200 | AED 6,800 | AED 6,833 |

Porsche Cayenne | AED 5,500 | AED 6,000 | AED 5,750 | AED 5,750 |

Porsche Taycan | AED 7,000 | AED 7,500 | AED 7,200 | AED 7,233 |

Porsche Macan | AED 5,000 | AED 5,500 | AED 5,200 | AED 5,233 |

Porsche Panamera | AED 6,800 | AED 7,300 | AED 7,000 | AED 7,033 |

Classic Porsche | AED 4,500 | AED 4,800 | AED 4,700 | AED 4,667 |

As you see, prices are different. For example Porsche Panamera insurance cost is higher than Porsche Macan insurance cost or Porsche Cayenne insurance cost.

Besides the fact that Panamera has a higher value, demand for this model in the market is also higher.

Find the Best Porsche Auto Insurance Plans with Lookinsure

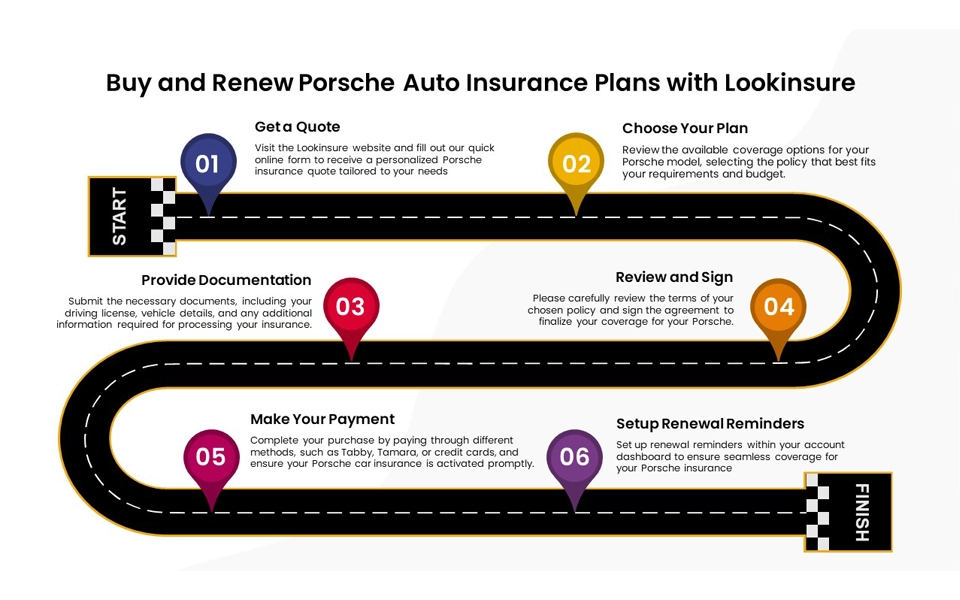

Here’s a simple, step-by-step guide to buying and renewing your Porsche insurance plans with Lookinsure:

Step 1: Get a Quote

Visit the Lookinsure website and fill out our quick online form to receive a personalized Porsche insurance quote tailored to your needs.

Step 2: Choose Your Plan

Review the available coverage options for your Porsche model, selecting the policy that best fits your requirements and budget.

Step 3: Provide Documentation

Submit the necessary documents, including your driving license, vehicle details, and any additional information required for processing your insurance.

Step 4: Review and Sign

Please carefully review the terms of your chosen policy and sign the agreement to finalize your coverage for your Porsche.

Step 5: Make Your Payment

Complete your purchase by paying through different methods, such as Car Insurance Tabby, Tamara, or credit cards, and ensure your Porsche car insurance is activated promptly.

Step 6: Setup Renewal Reminders

Set up renewal reminders within your account dashboard to ensure seamless coverage for your Porsche insurance when your policy term approaches its end.

Top Porsche Car Insurance Providers in the UAE

Several insurance companies in the UAE specialize in insuring high-end cars like Porsche, providing tailored coverage options that safeguard your investment. Here are some of the top Porsche car insurance providers in the UAE that are recognized for their quality service and comprehensive coverage options and works with Lookisnure:

Emirates Insurance Company | Emirates Insurance Company offers comprehensive coverage and tailored policies specifically for Porsche. Their robust customer service and various plans make them popular among Porsche owners. |

Abu Dhabi Insurance Company | Abu Dhabi Insurance Company offers competitive rates and extensive coverage options for various Porsche models. Its focus on customer satisfaction and efficient claims processing makes it reliable. |

Orient Insurance | Orient Insurance company is known for its strong reputation in the UAE for insuring luxury cars, including Porsche insurance. They offer flexible policies, add-ons, and excellent customer service to assist clients throughout the Porsche car insurance process. |

Dubai Insurance Company | Dubai Insurance Company specializes in providing comprehensive auto insurance solutions for high-end vehicles. Their policies for Porsche owners include additional benefits such as roadside assistance and personal accident coverage. |

Al Fujairah National Insurance Company | Al Fujairah National Insurance or AFNIC Company offers customized plans for insuring luxury vehicles, emphasizing customer support. Its policies cover both comprehensive and third-party options for Porsche cars. |

Oman Insurance Company | Oman Insurance Company, also named Sukoon Insurance, is known for its competitive premiums and extensive coverage options for Porsche car insurance. Their efficient claims handling and customer-focused service make them a preferred provider in the UAE. |

How to Claim a Porsche Auto Insurance Policy?

Claiming your Porsche motor insurance policy can seem confusing, but following a straightforward process helps ensure a smooth experience. Here’s how to effectively file a claim:

- Contact Your Insurer: Immediately notify your insurance provider about the incident. Many companies have 24/7 claims hotlines. You can also make contact with Lookinsure claim department to help you there.

- Gather Information: Collect all relevant details about the incident, including:

- Date and time of the accident

- Location of the accident

- Description of what happened

- Contact details of any other parties involved

- Photos of the scene and vehicle damage

- Complete a Claim Form: Complete the insurer's claim form, providing accurate information about the incident and the damages involved.

- Submit Documentation: Attach necessary documents, such as:

- Your insurance policy number

- Driving license

- Vehicle registration

- Photos of the damage

- Police report (if applicable)

- Follow-up: After submitting your claim, contact your insurer to request an update on its status and any additional information they may need.

- Review Settlement Offer: Once your claim for Porsche car insurance is processed, review any settlement offers made by your insurer. Confirm your acceptance if you agree with the amount offered for repairs or damages.

- Receive Payment: After finalizing the claim, the payment will be issued according to the terms of your insurance policy, either to you or the repair shop.

NOTE: You can skip most steps by contacting our experts at Lookisnure. They coordinate the Porsche insurance claim process and tell you about the final result and an agency's repair of your car.

Documents Required for Porsche Car Insurance

When applying for Porsche car insurance, it's important to have the necessary documentation ready beforehand. Below are the required documents typically needed for different steps (renewing, buying, filing a claim):

| Copy of Passport | If you are an expat |

| Driving License | - |

| Vehicle Registration | Proof of ownership, usually the vehicle registration certificate ("Mulkiya") |

| Previous Insurance Policy | If applicable, details of your current or previous Porsche insurance |

| Emirates ID | you can also use an Emirates pass |

| No Claim Discount Certificate | Documentation from your previous insurer indicating a no-claim history (if available) |

| Proof of Address | A recent utility bill or bank statement showing your residential address |

| Vehicle Chassis Number | The chassis number for identification and inspection of the vehicle |

| Completed Application Form | The insurer’s specific insurance application form is filled out with your details |

Securing Porsche car insurance and finding the best insurance for Porsche requires Knowing the top Porsche insurance providers in the UAE, Learning the steps for filing a claim, preparing documents for buying or renewing a policy, and comparing Porsche insurance rates by different companies. You can rely on Lookinsure to find the best deals out there.