Range Rover Car Insurance in UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Getting your Range Rover car insurance in UAE is essential to protecting your investment, avoiding financial consequences, and taking care of your vehicle. Car insurance is mandatory in the Emirates,, and driving without one is illegal. However, protecting your high-value car goes beyond just following the rules.

This article will cover all you need to know about Range Rover insurance. If you want to know what type of insurance suits your vehicle and what you can do to protect your Range Rover to the fullest, this article is for you.

Range Rover Insurance Types

When choosing your Range Rover car insurance policy, there are a few options you can pick from. Your insurance coverage can vary depending on the policy you pick. Below are the Range Rover insurance types and options available in the UAE;

Comprehensive Range Rover Car Insurance

Comprehensive car insurance for a Range Rover is commonly referred to as a full coverage policy, which includes protection against damage from third-party liabilities, natural disasters, fire, theft, and road incidents. This coverage is generally recommended for all luxury car owners due to its high level of protection. However, the key difference between this type of comprehensive insurance and standard plans is that it is specifically tailored for Range Rovers. As a result, you receive professional protection dedicated to your vehicle.

Third-Party Range Rover Car Insurance

Third-party car insurance is the lowest level of mandatory insurance in the UAE. This coverage only protects your car from damage caused by third-party liabilities, such as self-injury and property damage. The Range Rover third-party insurance is also tailored to your requirements and your special car.

Range Rover Car Insurance Add-ons

Car insurance add-ons are an excellent way to enhance coverage in specific areas and customize a policy. You can even choose a standard plan with low coverage and tailor it according to your priorities using optional Range Rover add-ons. Some popular add-ons include roadside assistance, zero depreciation coverage, engine and gearbox protection, personal accident coverage, key replacement, windshield or glass breakage, total loss, and more. For Range Rover owners, these add-ons are specially designed for this manufacturer, considering the brand's unique features and vehicles. A notable add-on for Range Rovers is the Range Rover Protection Package, which safeguards your Rover against all potential threats.

Range Rover Car Insurance for Popular Models

Range Rover car insurance covers models such as the Velar and Sport. Premiums tend to be higher because of their luxury status and repair expenses. Policies typically encompass liability, collision, comprehensive coverage, and discounts for safety features. Tailoring coverage ensures it meets your specific model and driving requirements. Below, you can find Range Rover car insurance for some of the most popular models:

Range Rover (full size)

Range Rover full size refers to the larger, flagship model of the Rover. This big and spacious SUV is great for families. Its off-road capabilities make it a great choice for UAE’s landscapes and weather conditions. This vehicle's estimated car insurance fee can range from AED 3000 to AED 10000 annually for comprehensive policies and AED 1000 to AED 3000 for third-party policies.

Range Rover Sport

The Range Rover Sport is one of the most popular models in the UAE. This luxury SUV combines elegance with off-road capabilities, a refined design, advanced technology features, and powerful performance. Insurance costs for the Range Rover Sport range from AED 6000 to AED 12000 per year for comprehensive coverage and about AED 1,500 to AED 3,500 for third-party liability per year. Car insurance for the Range Rover Sport is among the most sought-after policies for this manufacturer.

Range Rover Velar

The Range Rover Velar is a luxury midsize SUV between the Evoque and Sport models in size and cost. It offers various engine options with great performance and is dedicated to different needs. The luxurious cabin has a fantastic design. Range Rover Velar car insurance costs AED 4000 to AED 10000 annually for comprehensive policies and AED 1,500 to AED 4,000 for third-party liabilities.

Range Rover Autobiography

Range Rover Autobiography is a high-end, top-tier Range Rover lineup trim level. This vehicle is one of the most premium Range Rover models available, and the Emiratis love it. This vehicle offers a range of engine options and is also great for UAE’s weather conditions. Exclusive elements such as a unique exterior, advanced lighting, and larger wheels make this car special. Autobiography Range Rover insurance cost is around AED 8000 to AED 12000 annually for comprehensive policies, and AED 1,500 to AED 3000 for third-party liabilities.

Range Rover model | Comprehensive insurance cost (annually) | Third-party liabilities insurance cost (annually) |

Range Rover (full size) | AED 3000 - AED 10000 | AED 1000 - AED 3000 |

Range Rover Sport | AED 6000 - AED 12000 | AED 1,500 - AED 3500 |

Range Rover Velar | AED 4000 - AED 10000 | 1,500 - AED 4,000 |

Range Rover Autobiography | AED 8000 - AED 12000 | AED 1,500 - AED 3000 |

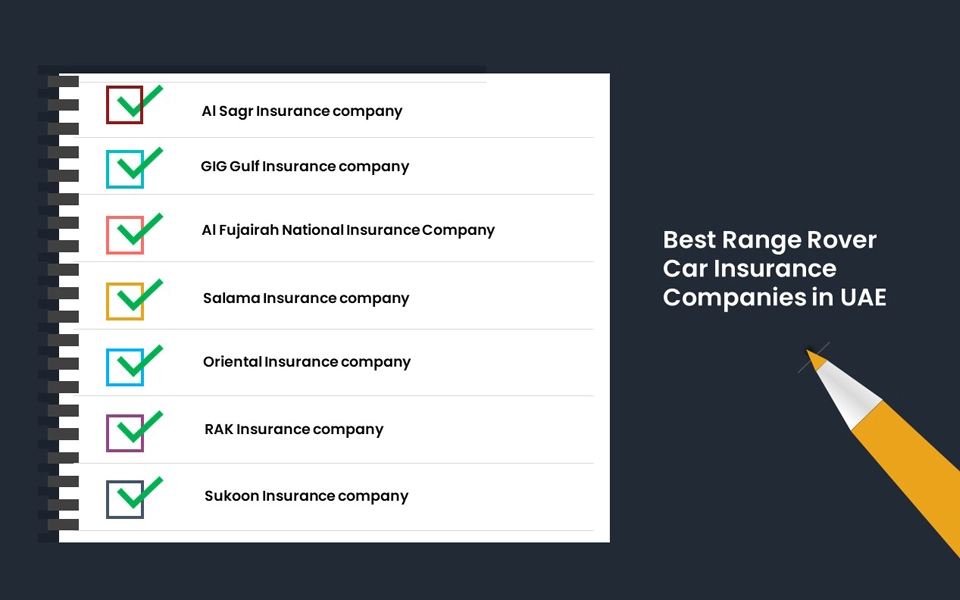

Top Range Rover Car Insurance Providers in UAE

Lookinsure has partnered with UAE’s top Range Rover insurance providers to offer clients the best services at the most reasonable prices. Below is a list of some of UAE’s most renowned insurers that you can get your Range Rover sports insurance or other insurance policies from:

Al Sagr Insurance company

Known as one of UAE’s leading insurers, Al Sagr insurance company offers customers expert services alongside authentic parts. With over 30 years of experience in the insurance industry, the company is familiar with customer’s needs.

GIG Gulf Insurance company

GIG Gulf Insurance is a prominent insurance company in the Emirates and is also known in other GCC countries. The company provides tailored insurance solutions and is reputed for its luxury car services and policies, helping clients experience a peaceful insurance procedure.

Al Fujairah National Insurance Company

It is impossible to drive in the UAE and not know about Al Fujairah National insurance company. Also referred to as AFNIC, the provider has strong financial backing and decades of experience in the insurance market. AFNIC offers some of the best insurance products and services to drivers in the UAE.

Salama Insurance company

As one of the oldest insurance providers in the Emirates, Salama insurance company team of experts has extensive experience in the insurance field. This makes them capable of handling tough insurance situations. Salama is an ideal provider for car owners looking for a tailored plan.

Oriental Insurance company

Oriental insurance company prioritizes all needs and requirements. It offers a wide range of insurance products, with a special and suitable plan available for everyone. From car insurance to life insurance services, Oriental is an excellent pick for your Range Rover insurance.

RAK Insurance company

Ras Al Khaimah National or RAK Insurance Company is a leading insurer in Ras Al Khaimah. Renowned for its strong commitment to customer satisfaction, RAK ensures every client enjoys a seamless insurance experience. RAK allows policyholders to tailor their plans by providing affordable Range Rover insurance solutions.

Sukoon Insurance company

Sukoon Insurance company is a prominent insurance provider in the UAE and an excellent choice for your Range Rover car insurance policy. Offering full coverage, comprehensive policies, and special add-ons, Sukoon ensures you get a tailored plan according to your unique requirements.

Buy Range Rover Car Insurance Online

Buying your Range Rover car insurance is possible with Lookinsure by following the steps below:

- Go to Lookinsure’s website

- Navigate to ‘get an instant quote’

- Answer essential questions

- Provide information about your driving license and plate number

- Review suitable quotes

- Compare quotes

- Choose the policy that speaks to your

- Select optional add-ons

- Confirm policy

- Make the payment

- Wait for confirmation

Renew Range Rover insurance

The renewal process is a simple process through Lookinsure by following the steps below:

- Go to Lookinsure’s website

- Sign into your account

- Review your panel

- Review your ongoing/previous policies

- Select the policy you wish to renew

- Read the policy and make necessary alternations

- Renew policy

- Make the payment

- Wait for confirmation

Documents Required for Range Rover Car Insurance

Like any other legal procedure, getting your Range Rover insurance requires several essential documents. These documents are as follows:

- Emirates ID

- Visa and Passport (for expatriates)

- Valid UAE driving license

- Vehicle registration card

- Bank statements

Claim Range Rover Car Insurance Online with Lookinsure

In case you get into an accident or an incident happens to your vehicle that falls under your policy’s coverage, you can file your Range Rover insurance claim by following the steps below:

Call The Police

Before anything, call the police. This is essential for safety reasons and to receive police reports as evidence.

Inform Your Insurer

Inform your insurer about the incident.

Fill Out A Claim Form

Fill out the claim form available on Lookinsure’s website.

Attach Necessary Documents

Provide the required documents, including evidence such as photos and a police report.

Submit Claim Form

Submit the claim form after carefully filling it out.

Follow Claim Status

You can follow your claim status through Lookinsure’s website.

Getting Range Rover car insurance in the UAE is very common. Insurance is mandatory for all vehicles and drivers. However, an insurance policy for a luxury car such as a Range Rover is a bit riskier. This means that your policy should cover all the necessities to protect such luxury vehicles. Lookinsure has gathered all of the UAE's best insurers to enable customers to find tailored solutions to their insurance needs.

Frequently Asked Questions

Answers to common questions about Range Rover insurance.